There are some ways that AI is becoming obvious in our daily lives, be it in the driverless technology found in cars or in the tailored content selected for you by streaming services. Many of us have received a reassuring text message from our banks, verifying that the recent payment was you and not some fraudster. You can thank the watchful eye of anomaly detection algorithms that have been keeping our money and accounts safe.

Businesses are similarly coming to rely on machine learning to inform critical decision-making. Increasingly, machine learning is finding its place throughout organizations, from customer retention to marketing and finance. Assurance and audit are no different. As the value of these technologies becomes clear and society expects more, pressure builds on auditors to improve.

Reasonable to ask for more assurance

The standards have required auditors to deliver a ‘reasonable’ level assurance, a level that is not absolute but rather a high level determined, really, by a shared sense of best practices. Over the last few years, we have seen auditors adapt to the way they are working, and the way they demonstrate their quality. This is largely in response to the market; buyers are becoming more sophisticated. “Audit committees require audit firms to provide extensive evidence to demonstrate their quality. It has become normal to test a firm’s technology, including its data analysis capabilities,” noted PwC in 2018.

This is a trend that we are seeing in multiple markets, with a top US firm commenting that “our client’s technology and data availability plays a role in drivers of change. The more clients are using technology, their expectation is elevated on our use of technology.” What constitutes a reasonable level of assurance is changing.

Regulators are aware of the positive impact that new technologies can deliver, with the PCAOB foreseeing that “the future of audit will be able to provide a greater level of “reasonable assurance” as auditors may be able to examine 100 per cent of a client’s transactions.”

This view is also backed up in a large review of the UK Audit market performed by Sir Donald Brydon. ” As such technologies become widespread in use, stretching beyond journal testing, they will clearly have an impact on the cost of audit (less human checking) and on the depth of testing that will be possible” noted Brydon.

Cost savings and the search for efficiencies have often been key drivers of technology adoption in audit for audit partners, but the importance of demonstrating higher levels of audit quality has become clear. The fact that BDO calls out technology as a key aspect in their recent win of SAP as an audit client demonstrates this fact.

AI: An enabler for risk-based auditing

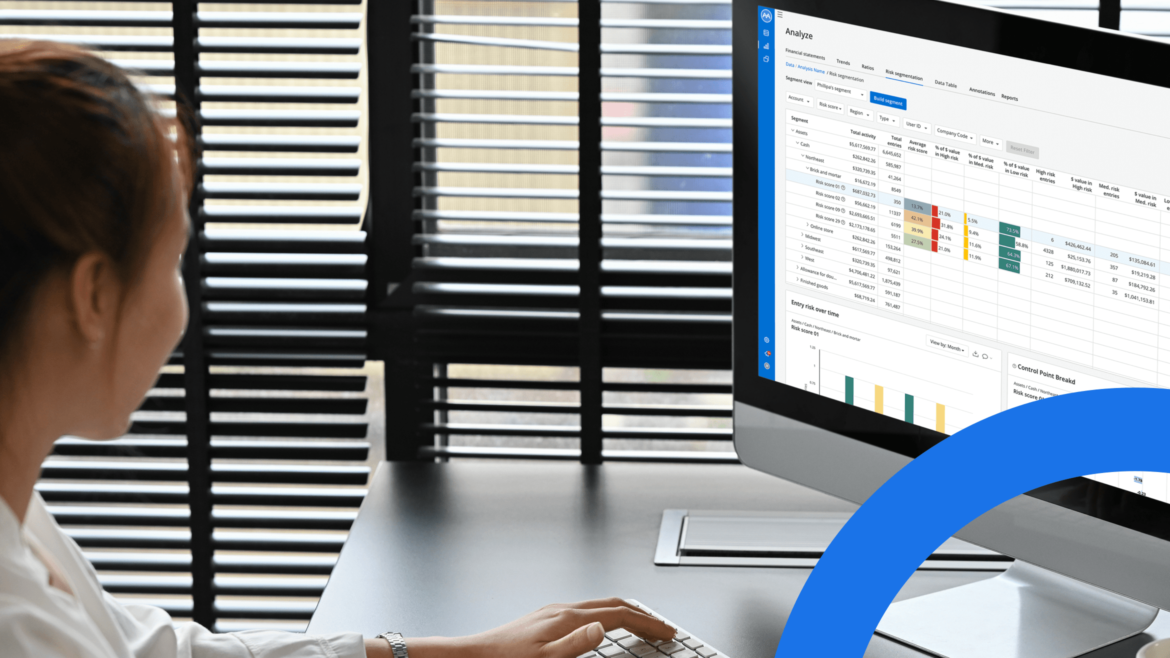

Whilst the PCAOB speaks of transaction scoring as a technology of the future, firms are leveraging MindBridge’s 100% risk scoring across the US today. By scanning transactions using a variety of techniques, auditors are both better able to assess risk, and better able to find those risky and unusual transactions. This translates to an audit with less ticking-and-tying, and a greater focus on what matters. It allows fewer audit staff to get through more information and provides greater assurance at the end of it all.

An example of an audit algorithm in action is MindBridge’s “outlier detection.” This category of algorithm identifies unusual financial patterns, helping fulfil the requirement of ISA 240, which sets an expectation for auditors to look for unusual activities. An additional benefit of outlier detection is that its methodology consists of unsupervised machine learning, meaning algorithms are not trained or taught on specific data.

This overcomes bias in data analysis, with reviewed transactions (i.e., the general ledger of companies), identifying what is normal for the audited entity and separating out what is empirically unusual activity.

The unsupervised methods of outlier detection allow for data to be analyzed and anomalies drawn out without requiring training on similar entities. It can also be applied to all types of organizations, irrespective of their size or industry.

While outlier detection is effective for detecting new activity and outliers in data, it does not have a prior or pre-existing understanding of accounting processes. It is our belief that there is still a role for the expert system in the context of risk scoring for audit. MindBridge’s “Expert Score” is an example, it’s an indicator that flags transactions based on a database of pre-existing rules determined to be unusual. Write-offs directly between cash and expense will consistently get flagged by Expert Score.

Expert Score has recently been enhanced by looking at the prevalence of financial flows in the data selected to take part in our curated learning process. Unusual transaction flows are studied and documented before being added to the Expert Score rule base.

Demonstrating quality: key to growth

By leveraging these techniques and changing the profile of work, the firms that are most successfully implementing MindBridge are driving success in the market and growth. By speaking to the value throughout the customer lifecycle, these firms are ensuring that the customer sees the value of working with them.

Expand your expertise, watch this short webinar from MindBridge here and learn how firms are adopting AI to drive growth.