Financial risks have nowhere to hide

Prebuilt and scalable algorithms continuously analyze all data, exposing risks through the contextual lens of an auditor, regulator, or bespoke internal controls.

Advanced machine learning

Out of the box algorithms find patterns in datasets without the need of supervision. The platform identifies data relationships and structures, surfacing patterns of unusual behavior that a human would never find.

Discover trends and risks otherwise unnoticed in your most important data, free from external influence and bias.

Process hundreds of millions of rows, offering greater risk coverage and overcoming traditional data volume challenges.

Transparent AI and clear documentation provides credible results, creating trust in your most critical financial data.

A unique ensemble AI approach

By leveraging multiple techniques simultaneously, enhance your ability to identify errors and anomalies, resulting in broader risk detection and coverage.

Data Systems and Sources

Data Systems and Sources

Conduct 100% transaction analysis to understand information flows and identify data sources within systems of record to ensure accurate and accessible data for better analysis.

Fraud and Anomaly Detection

Fraud and Anomaly Detection

Spot unusual patterns early to catch fraud before it escalates into major issues. By identifying irregularities, organizations can take proactive measures to protect your assets and reputation.

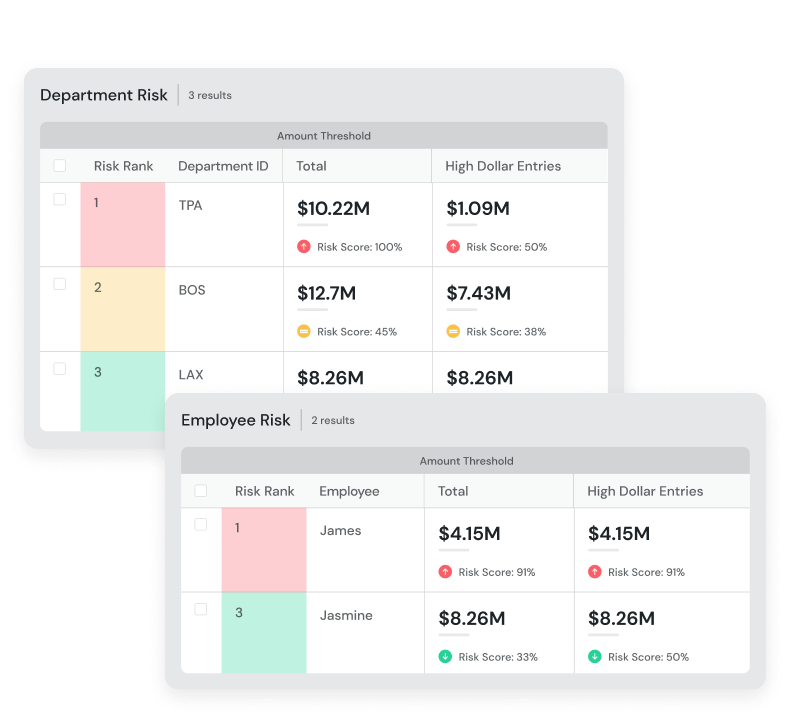

Aggregated Risk Management

Aggregated Risk Management

Analyze data from various angles to provide a comprehensive view of risks across the organization. This holistic perspective enables better risk assessment and more effective mitigation strategies.

Accelerated Transformation Initiatives

Accelerated Transformation Initiatives

Empower your organization to implement changes swiftly and successfully with out of the box insights. More accurate information is at your fingertips, driving transformation initiatives that align with your strategic goals.

Operational Efficiency

Operational Efficiency

Streamline processes and reduce inefficiencies leading to smoother and faster operations. By optimizing workflows, organizations can improve productivity and reduce costs.

Statistical Models

Statistical Models

Examine financial data with various statistical models to detect irregularities by comparing it to expected patterns. Techniques such as Benford's Law and linear regression are used to highlight deviations that may indicate potential errors, fraud, or anomalies.

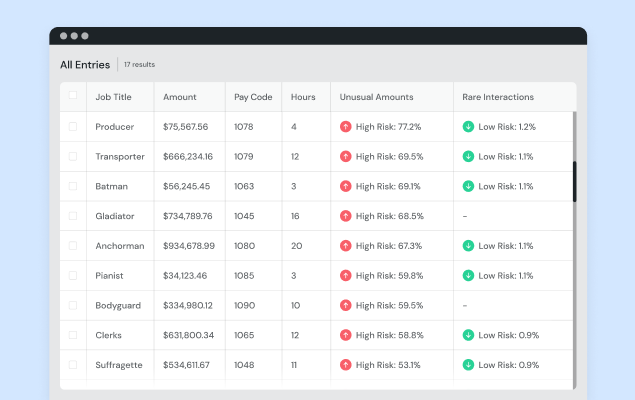

Machine Learning

Machine Learning

Unsupervised machine learning models analyze changes in transaction amounts, rare interactions, and shifts in activity volume without predefined parameters. These models learn patterns from the data itself, dynamically detecting anomalies that may signal risks or irregularities in financial processes.

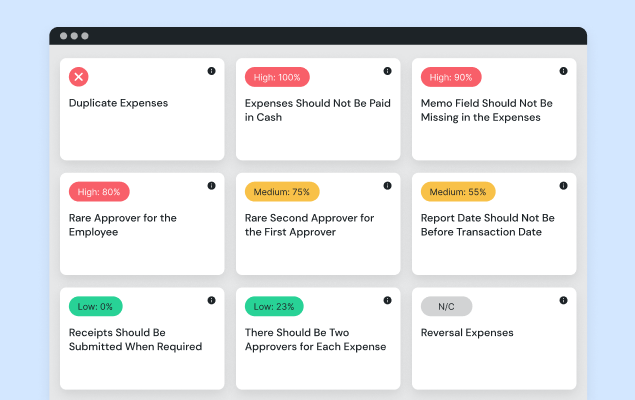

Business Rules

Business Rules

Customer defined criteria within financial or business processes that flag potential risks. These are hardcoded rules based on expert knowledge, helping quickly identify anomalies in data that trigger exceptions to expected patterns.

A unique ensemble AI approach

By leveraging multiple techniques simultaneously, enhance your ability to identify errors and anomalies, resulting in broader risk detection and coverage.

Traditional financial controls are antiquated and inflexible

Finance and audit teams can no longer keep up with the volume and velocity of data changes caused by digital transformation programs.

The challenge is multiplied by the ever-changing risk and regulatory compliance landscape. Companies struggle to keep up with the velocity of change.

Adaptable transaction oversight with AI-powered financial controls

Choosing MindBridge for anomaly detection offers quicker deployment, ongoing support, and proven effectiveness. This allows your team to leverage a robust, trusted solution without needing specialized machine learning expertise, enabling them to focus on higher value-added work.

Shortcomings of Traditional Approaches

1

Finance, Accounting, Operations

Errors in month-end close

Inaccurate budget forecast

Inefficient manual processes

Regulatory non-compliance

Unknown emerging risk

2

Control, SOX, Risk, Compliance, ERM

Lack of process automation

Ineffective controls testing

Subjective risk assessment

Manual control reliance

Limited scope

3

Internal audit, Investigations

Reactive IA planning

Limited detection coverage

Missed fraud indicators

Highly manual workload

Inconsistent results

Leveraging the MindBridge AI™ platform

Specify data set

MindBridge ingests complex and voluminous transactional data sources, including all relevant fields for analysis.

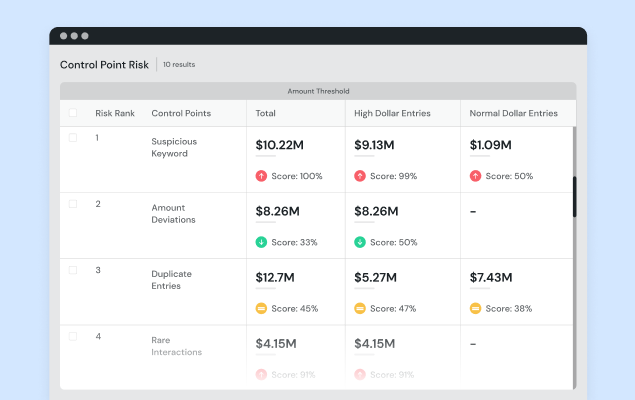

Pick control points

Select from a series of tests ranging from business rules, statistical models and machine learning, to combine an ensemble tailored for your specific dataset.

Analyze data

Automate the analysis of 100% of financial transaction data population, driving actionable insights to support informed decision-making and drive organizational success.

Algorithms you can trust

Ensemble AI leverages out of the box control points that combine your business rules, statistical models, and unsupervised machine learning.

Flags entries with amounts that do not align with the expected distribution of amounts.

Augmenting digital transformation

To grasp the significance of AI and ML in finance and accounting, it’s essential to understand their capabilities.

What our customers say about us