Financial professionals are inundated with vast amounts of data, making it increasingly difficult for teams to sift through information and identify areas of concern. Our users want a solution that doesn’t just show them the data, they want to be told exactly where risks are lurking and how to act on them. Traditional methods, even those augmented by advanced analytics, often leave users overwhelmed with complex outputs, leading to inefficient risk identification and missed opportunities.

At MindBridge, we realized that while our control points and machine learning models have been highly effective, the true value lies in how easily users can interpret and act on the insights. Users, like internal auditors and finance professionals, don’t have time to comb through every detail, they need a system that not only analyzes the data but presents it in a way that points directly to actionable steps.

To address these challenges, we’ve focused on developing solutions that enhance the user experience, streamline workflows, and ensure users can easily interpret data and take immediate action. This release brings several key features designed to meet these needs:

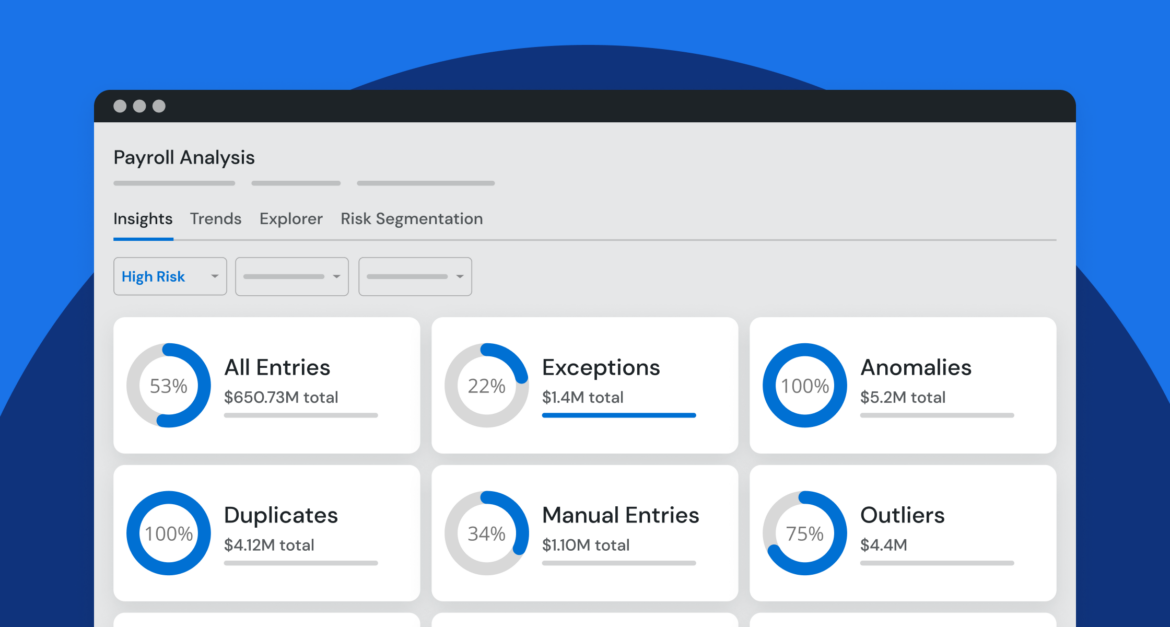

Insights Dashboard and Data Explorer

The new Insights Dashboard provides a clear, high-level summary of financial risk intelligence, helping users quickly pinpoint areas of concern. For deeper analysis, the Data Explorer allows users to drill down into detailed data, ensuring a smooth transition from summary to investigation. This combination of tools streamlines the workflow, enabling teams to efficiently identify, analyze, and address high-risk areas with full data transparency and confidence in decision-making.

Expanded Machine Learning Capabilities

We have expanded our machine learning models across payroll, vendor, customer, and travel & entertainment (T&E) solutions. These enhancements allow users to identify anomalies, exceptions, and inefficiencies faster and with greater depth. Alongside machine learning, we’ve implemented advanced business rules tailored to commonly seen company policies. These rules help detect exceptions based on predefined thresholds and guidelines, ensuring that policy violations or irregularities are quickly flagged for review.

These new features transform how users interact with financial data, focusing on actionable insights that enable quick decision-making. With enhanced capabilities simplifying the navigation of complex datasets, users can detect risks and inefficiencies more quickly, reducing investigation time and increasing productivity—all without needing specialized data science expertise.

This release is built on one goal: enabling finance teams to act faster, smarter, and with greater confidence, ensuring risks are managed before they escalate. Stay ahead of the curve with our latest tools that simplify financial risk management and transform data into action.

Explore our What’s New page to learn more or reach out to one of our MindBridge experts to discuss how these innovative capabilities can help usher your organization into the age of AI-powered financial risk intelligence.