Klaus Schwab, the Founder and Chairman of the World Economic Forum, shares in his book, “The Fourth Industrial Revolution,” that artificial intelligence (AI) will perform 30% of corporate audits by 2025. While any estimate of change is just that, an estimate, the pace of change is governed by the benefits that result from the application of any given technology, weighed against the forces opposing it.

In the case of government finance and accounting, AI is being embraced at an astounding rate, and may even accelerate if we are able to overcome some of the forces opposing the change.

The benefits of AI to government are being proven out in its early usage today, namely employee efficiency, risk mitigation, and operational insights. These three value propositions are driving the rapid adoption of AI as a financial control, an audit tool, and a forecasting function, and will help ensure that governments at all levels are better managing the public’s finances.

What AI brings to government finance and accounting

Take the case of a large Canadian federal government department. Financial analysts, by policy, are asked to manually review every travel expense that exceeds $1000 CDN. This is the type of task that is ripe for automation via AI, as AI can rapidly analyze all the expenses at once and determine those that are the riskiest to review. AI allows the department to be more efficient, as it can prioritize its resources to review the riskiest expenses, the ones most likely to contain an error, omission, or a violation of the expense rules, and automatically approve the vanilla claims.

While operational efficiency has the greatest monetary value to government organizations, the value of risk mitigation centers around the trust placed in government financial operations. Whether a financial error, omission, or fraud is found to be above or below the material threshold of the organization, the impact on the public’s perception of the competence of its management and staff is always put into question.

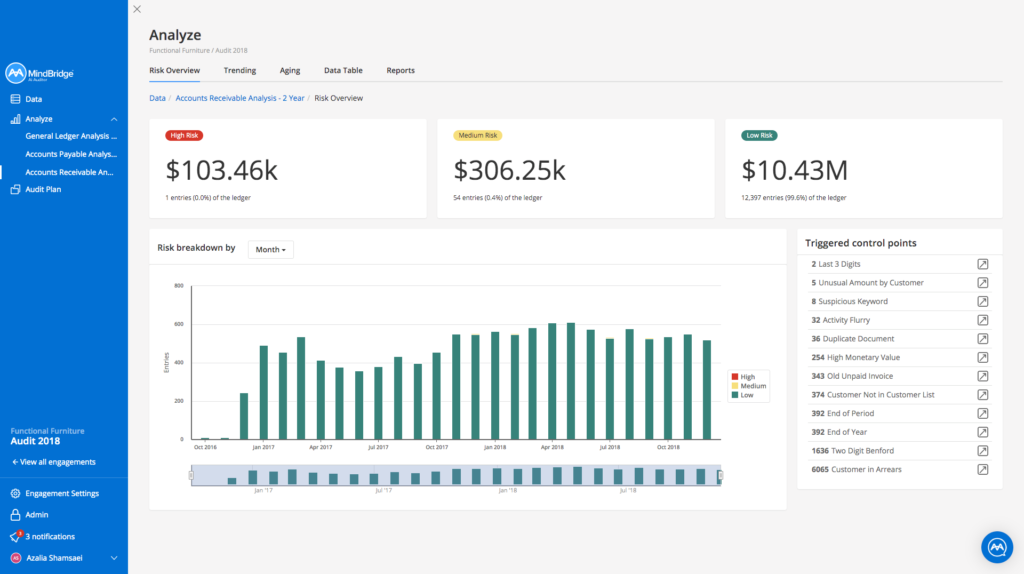

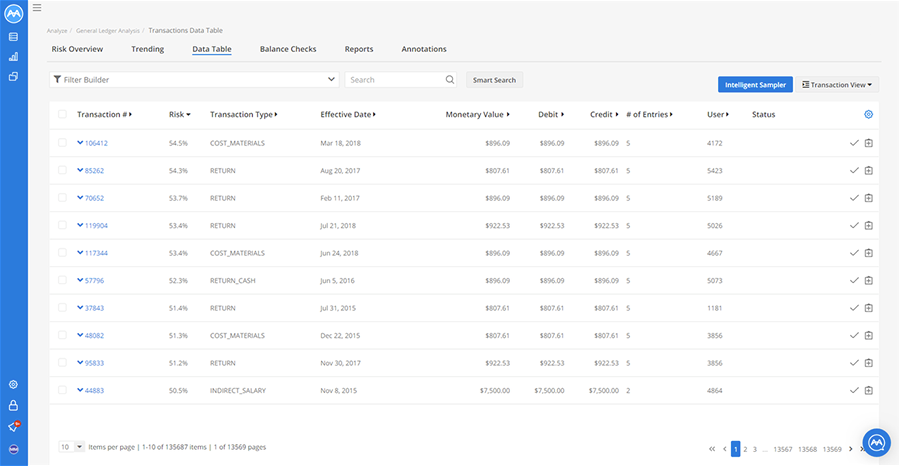

With financial data growing at an exponential rate, (PwC estimated that 18 Zettabytes of financial services information was created worldwide in 2018), current audit and control techniques, including random sampling, are constantly failing to detect mistakes and fraud. AI provides a means of reviewing 100% of the data, allowing governments to find risky transactions and the associated parties, before it hits the press.

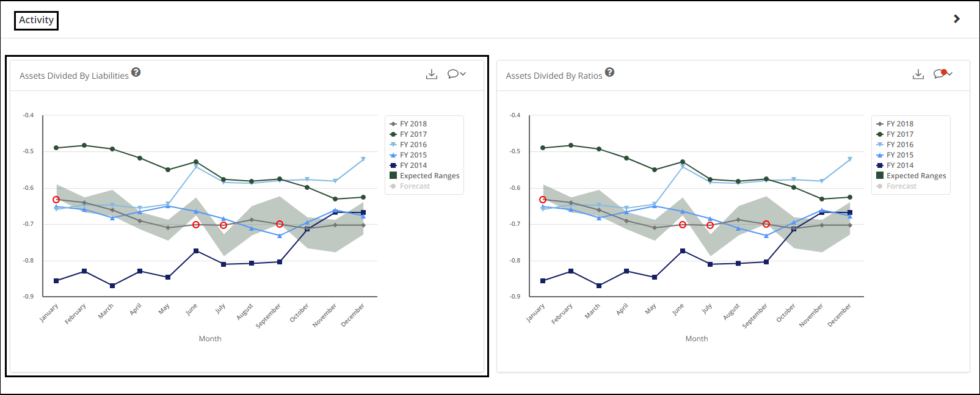

The operational insights provided by AI offer value to both the controller and the budget analyst. Controllers can use the risk ranking of transactions in a given year and visualize that risk against past years to spot areas of weakness in the control systems. Budget analysts can customize and visualize key performance indicators for the organization and use multiple years of data to predict how those ratios should evolve, and how they are tracking against them in any given quarter. Exceptions are highlighted so that action can be taken to apply additional budget or distribute resources to meet shortfalls.

Overcoming the human barriers to successful AI deployment

While these value propositions are helping speed the deployment of AI in government finance and audit, there are a number of human-centered forces that are putting a brake on wider adoption. Trust and transparency in the deployment of AI is one force against its adoption. How organizations change their processes to integrate AI is another. Lastly, the development of employee skills will ultimately predict the speed at which AI is adopted in organizations.

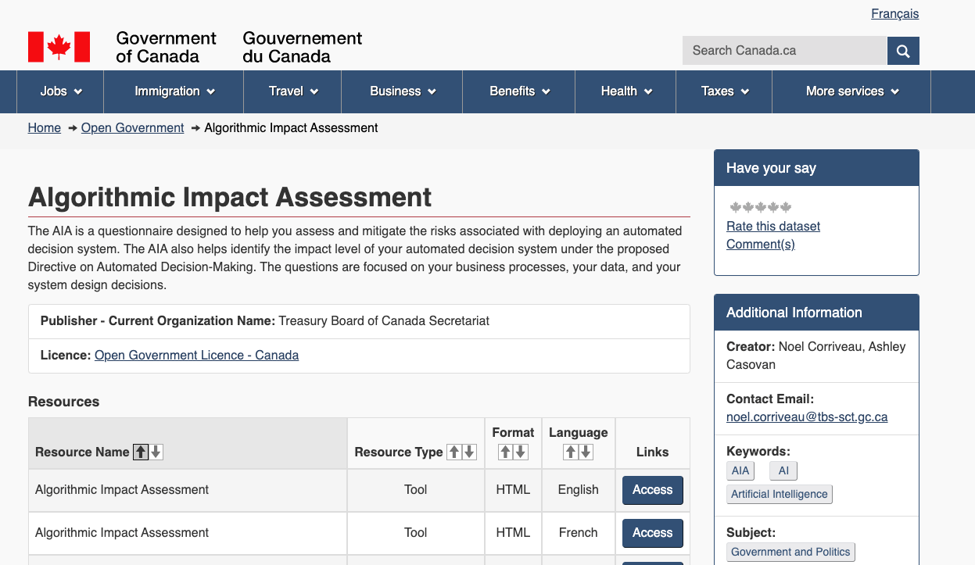

The Canadian government has proven itself a world leader in its adoption of the Algorithmic Impact Assessment (AIA) as a means of mandating transparency in the AI algorithms and how they are applied in any automated government service deployment. This move lays the basis for government departments to take advantage of AI automation that is explainable to the public, ensuring AI use can grow with appropriate oversight, and allowing trust to develop as a matter of process and not accident. Other countries have taken note of what Canada has done and are either adopting the Canadian AIA or are creating their own similar framework.

While building trust, it is also critical that government processes adapt to integrate AI. In the case of applying AI to reviewing $1000 expenses above, the policy governing the expense review process will have to be adapted to capture AI’s role. Policy, as we all know, doesn’t change overnight. The appropriate groups have to gather and review policy changes in the face of AI. There is also the issue of global and national regulatory standards that govern finance and accounting, particularly how and where AI-driven analysis can play a role. These conversations for change have already started, with the first major AI-driven changes to the audit standards process starting in 2020.

Skills are a huge part of any technology change. Just as blacksmiths evolved into being mechanics with the advent of the motor vehicle in the 1900s, financial officers and accountants are going to evolve into data analytics experts in the world of AI. One critical skill set is going to include the appreciation of numerical algorithms and analytical techniques and how they apply to the financial situation they are assessing. This doesn’t mean they have to become an algorithmic expert, or know how an algorithm is coded, any more than a mechanic needs to know how a motor vehicle is built. However, they need to know when their vehicle is good for driving on a paved road, and when it’s good for going off-road.

Data is the fuel of the future, and algorithms are the engines that will consume it.

It’s not a question of “if” AI will transform government finance and accounting, but “when”. With a strong set of value propositions driving the change, and the barriers of trust, adoption, and skills being diminished with increased awareness, leadership, and training, AI will be well enshrined in government before Schwab’s predicted date of 2025.

For a deeper dive into how AI helps government audits and financial management, watch my on-demand webinar now.

To learn more about our government solutions, including real use cases, visit our government finance page.