In these challenging times, virtually all organizations are faced with disruptions to the status quo. Depending on the industry and profile of one organization to the next, these disruptions can range from creating slight instability in day-to-day activities to having a catastrophic impact on the basic viability and sustainability of operations.

Transparent and accurate financial information and the auditor’s conclusions thereon are a cornerstone of market and investor confidence in the best of times, and the criticality of this responsibility is only magnified in the current environment.

The auditor’s procedures around the going concern assumption are therefore receiving an increasing focus and consideration by audit teams, particularly for engagements that are well-in-flight and in the concluding phase (i.e., just ahead of financial statements being formally issued). For example: a calendar 2019 audit engagement where financial statements haven’t been issued yet will need to consider a renewed examination of going concern.

How can MindBridge add value and assist in this assessment?

A going concern refresher

Management is required to make the assessment of whether the organization is a going concern for the foreseeable future and the auditor’s responsibility is to obtain sufficient and appropriate audit evidence to support this. If there is a material uncertainty (substantial doubt) regarding the entity’s ability to continue as a going concern, there are additional disclosure requirements in the financial statements and/or qualification of the audit report that may be required by the prevailing audit guidance.

While the applicable auditing standard framework and/or regulatory environment specific to your audit engagement may differ, this assessment must generally consider at least the period of 12 months from the reporting date (i.e., the balance sheet date). Often this requirement is extended for the auditor to consider the period of 12 months from the issuance of the financial statements.

Evaluating the going concern assumption under a new lens

Against the backdrop of the current crisis and considering the auditor’s responsibilities around the going concern assessment, some practical challenges may arise:

- The question of going concern may suddenly be relevant for an engagement or client that had previously never had any doubt regarding the sustainability of its operations. The company may be well capitalized, have a strong liquidity position, and demonstrable sales growth but is perhaps in an industry that is hard-hit by the crisis, introducing uncertainty into the assumption. Two considerations become relevant in this case:

- Management may not have the historical experience in providing material to support the going concern assumption (forecasts of P&L, cash flow, summarized non-financial data, etc.) for the foreseeable future, that is up to 12 months from reporting date or issuance date.

- The auditor may not have the historical experience in obtaining sufficient and appropriate audit evidence around the accuracy of the kind of “forward-looking” material on which management would base their going concern assertion. Further, there may not be any robust experience from previous years in the relationship with the client that objectively supports management’s ability to estimate forecasts effectively.

- There may be significant uncertainties around future outlook, especially in these (relatively) early stages of this crisis, and management may be challenged to make even the most basic assumptions in their forward forecasting. What will revenue look like and how long may it take to return to pre-crisis levels? How successful will receivable collection be? Where is there flexibility in discretionary expenditures? Various scenarios may be required to be modelled out, allowing for sensitivities in critical financial statement areas, that the auditor may have to review and consider on balance.

- These uncertainties around future outlook are currently mirrored in the realm of potential government assistance or relief that may be relevant for the organization. Governments and financial institutions are stepping in with significant relief measures being announced and operationalized but information around eligibility and interpretations is changing rapidly. Whether the form of this relief is subsidies, cash flows loans, or tax relief, these are critical inputs to support sustainability of operations that the auditor needs to consider.

How MindBridge helps evaluate going concern

MindBridge Ai Auditor is a powerful enabling tool for auditors to test the going concern assumption:

- Key trends and patterns can be surfaced

- Critical ratios can be visualized

- Transaction-level data can be interrogated

Let’s review each of these capabilities.

Trends and patterns

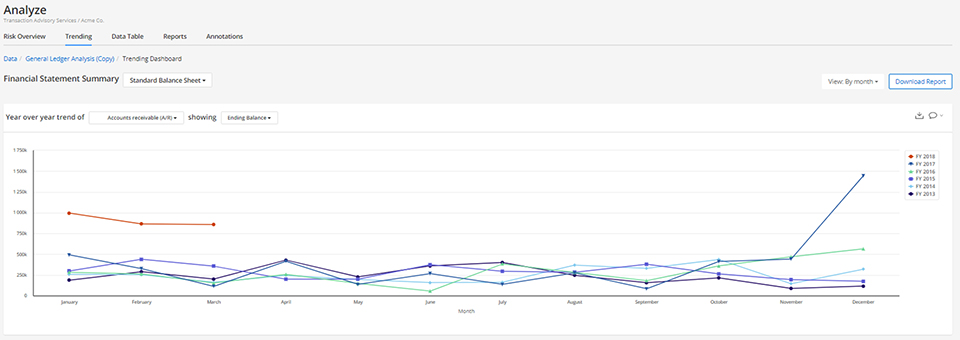

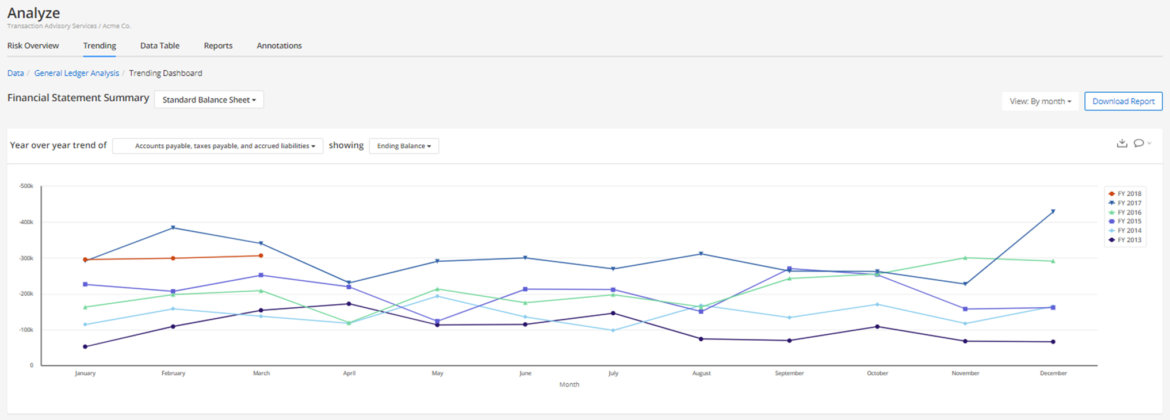

Ai Auditor allows for financial data to be visualized, layering in current year results against prior periods to surface critical trends and material deviations from history. The example here showcases trending of the accounts receivable line over time.

Within your engagement in Ai Auditor, you are able to create multiple analyses of your client’s financial information. You can create a new analysis that includes financial data from the period under audit and extend the analysis to include the most current financial information into the next fiscal year to assess the going concern assumption and management’s forecasts. This allows you to quickly understand more recent trends and let the data speak for itself against management’s assessment of near-term performance.

Other trended views, with examples, to consider around the going concern assessment may include:

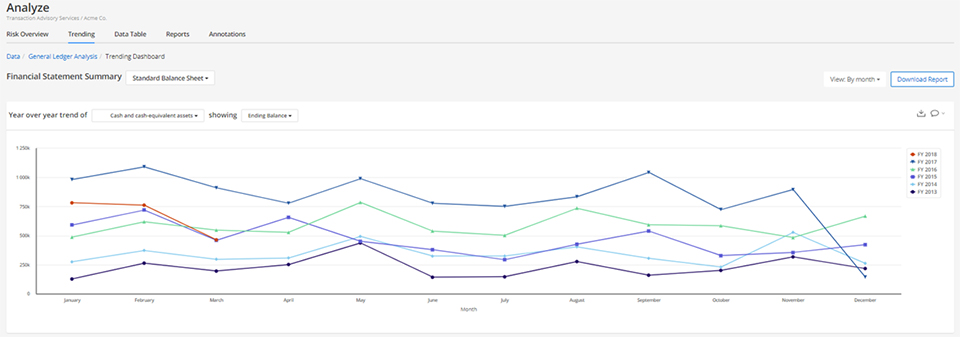

Visualizing cash over-time to get a sense of monthly burn and compare against management’s cash flow analysis. This allows for the review of sudden peaks that may indicate cash from financing or investing activities and can be normalized to derive a sense of cash flow from operations.

Visualizing accounts payable and the recent ability to settle balances owing to vendors. This can be compared against management’s cash flow analysis.

Other potentially relevant trending patterns to explore, as a reference:

- Visualizing short- and long-term debt facilities and consideration of whether these are indicative of a deteriorating liquidity position.

- Visualizing revenue trends and comparing them with the expense/cost of sales trends to understand where levers potentially exist for management to manage the economic shock.

Ratios

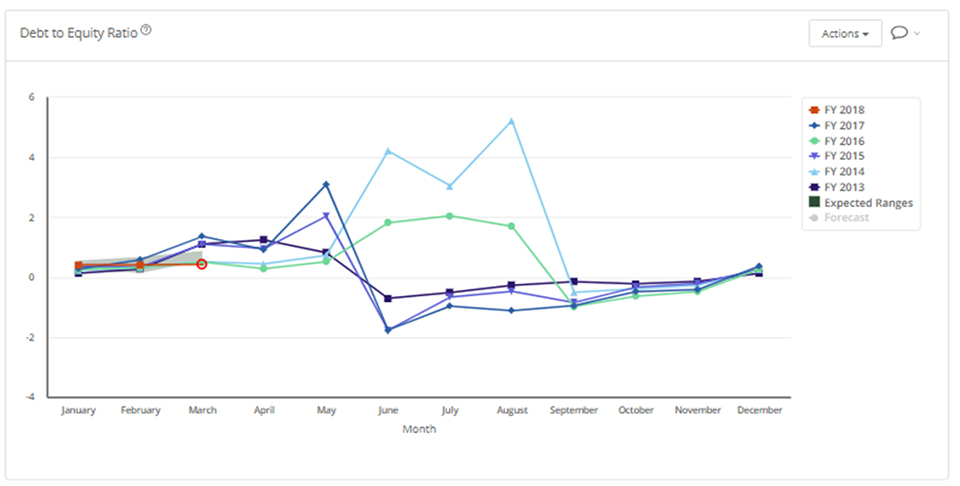

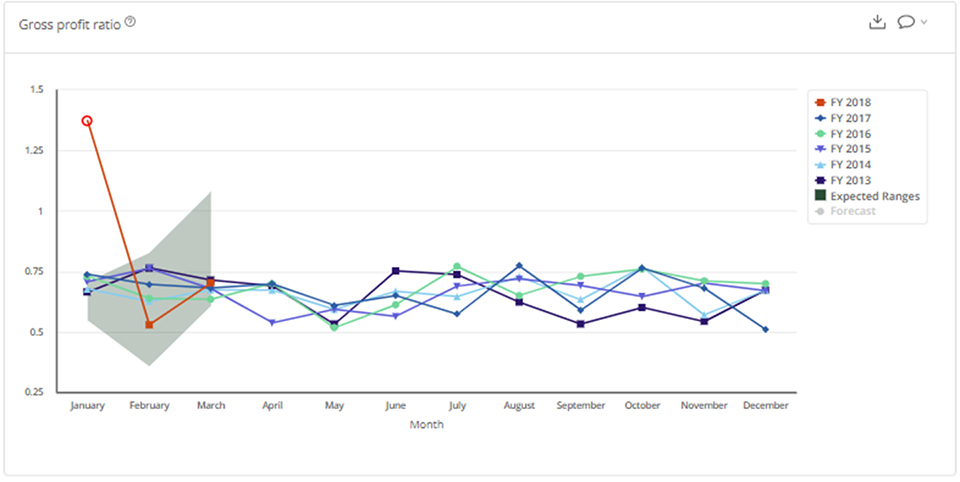

Ai Auditor includes a library of critical financial ratios that enable you to visualize how each of these metrics move through the year. You can easily create custom ratios that account for a specific industry that your client operates in or perhaps to mirror debt covenants that are in effect.

Similar to the Trending graphs, by extending your data to include more current financial information via a new analysis in your engagement, the ratio visualizations capture the recent movement in these key metrics and surface insights quickly.

Some examples:

Visualizing debt-to-equity ratio over time, and for the most recent period, to assess whether bank covenants are well within acceptable ranges or to get a sense of how operating lines are being tapped as a source of cash flow.

Visualizing gross profit as a percentage of sales over time, especially in recent months, to understand how the economic “shock” of the crisis has impacted margins and income statement relationships.

Other potentially relevant ratios and metrics to explore related to the going concern assessment, as a reference:

- Current ratio

- Working capital

- Debt to assets ratio

- Debt to equity ratio

- Expenses to sales ratio

- Long-term debt to net working capital ratio

- Accounts receivable to sales ratio

Pro tip: With more than four years (48 months) of historical financial information, a regression analysis called seasonal autoregressive integrated moving average (SARIMA) analysis is performed by Ai Auditor to graphically visualize the expected ranges for the ratio in the current period in addition to the trend lines. In the context of a going concern assessment, this can be extremely valuable to indicate whether a particular ratio or series of ratios is not only potentially down from pre-crisis level but also outside of a normal range. The latter might be more of a signal as it relates to sustainability of operations.

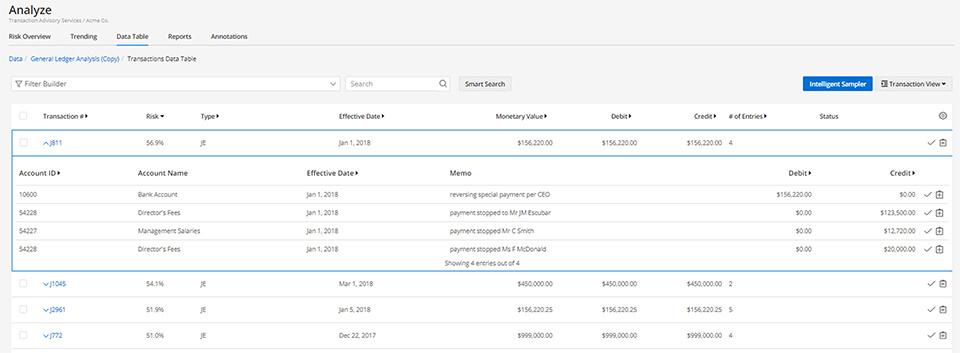

Interrogation of transaction-level data

Navigating and querying the transactional level data via the Data Table in Ai Auditor provides a powerful and effective way to explore and validate the nature of certain accounts in the ledger. The Filter Builder functionality allows for multiple conditions to be placed on a query, using any element of the transactional record (date, amount, user, etc.) as well as the relevant Control Points (the algorithms behind the analysis) that apply to a particular transaction.

Some examples of where this could be applied to the going concern assessment:

- Validating whether certain criteria for government assistance are met by your client, i.e., query for total amounts spent on payroll, rent, etc., in a particular period of time

- In evaluating management’s forecasted P&L against historical results, evaluate the implied assumptions of certain income statements accounts for reasonability, by understanding the nature and frequency of underlying transactions. For greater clarity, validate whether certain material categories of expenses are fixed or flexible in nature.

As the current crisis unfolds, it’s more important than ever for auditors to add value for clients and a going concern assessment is critical in understanding the basic viability and sustainability of operations. MindBridge Ai Auditor can help test this assumption by identifying key patterns (layering in current year results over prior years to surface critical trends), visualizing critical ratios (such as debt-to-equity or gross profit as a percentage of sales), and allowing for the in-depth interrogation of data through customizable filters.

To learn more about how Ai Auditor can help your going concern assessments, contact sales@mindbridge.ai.