An outlook on audit software trends in 2021-2022

In recent years, demand for accounting and audit software has been on the rise. Mostly, accounting professionals are looking for ways to speed up routine tasks and focus on what matters most—providing clients with valuable business insights and guidance on financial strategy. Already, many firms have seen how AI audit software can help their teams improve risk assessments and build stronger audit plans. That’s because some of the best audit software helps auditors become more efficient at combing through surging amounts of company data.

As we move through 2021 and into 2022, the interest in AI audit software isn’t slowing down. Below, we’ve identified five key trends that we believe will continue to propel the accounting and auditing industry forward in adopting AI audit software.

5 audit software trends to keep an eye on:

1. Increased demands for automating routine tasks

Accountants and auditors are under a lot of pressure to identify risks and turn reports over in the least amount of time.

The challenge is that when auditors use traditional data sampling and analysis methods, billable hours can add up fast. This is why in recent years there has been a push for greater automation in accounting practices using audit software. Some of the best audit software combines machine learning, data analytics, and AI to deliver higher levels of automation on routine tasks.

By automating processes with AI audit software, auditors can reduce the off-chance of human error while also ensuring 100% of the data is thoroughly analyzed for risks. This frees up an auditor’s time to focus other critical tasks such as exploring data trends and studying risks characteristics so they can ultimately deliver greater value to clients. As we move into 2022, these tangible efficiency gains will continue to drive the adoption of AI audit software.

2. Growing adoption of cloud-based solutions

In recent years, cloud-based software has become increasingly popular in the accounting and finance industries. Since these cloud applications are hosted in highly-secure remote datacenters, it’s easier for accountants to access information from home offices. They simply login to an online platform which is protected with built-in cybersecurity features.

If we look at statistics from 2018, about 43% of CPA firms already had employees regularly working from home. And according to Accounting Today, the global spread of COVID-19 has already contributed to a sudden surge of businesses moving over to cloud-based bookkeeping software.

Even before COVID-19, a survey conducted by Sage reported that about 67% of accountants believed that cloud technology can make their roles easier. And 53% of the respondents had already adopted cloud-based solutions for project management and client communication.

Near the end of 2021, we expect that this trend toward enabling remote work with cloud-based solutions will significantly increase for accounting and audit software as well.

3. Tackling big data in accounting

Big data is not just a buzzword anymore; it’s an opportunity for professionals to build strategy by analyzing large amounts of data from many sources. The problem is that data volume and sources can seem endless. In fact, there is broad agreement that the size of the digital universe will double every two years at least. IDC predicts that the Global Datasphere will grow from 33 Zettabytes (ZB) in 2018 to 175 ZB by 2025.

The ability to thoroughly mine the entirety of a company’s financial data requires smart tools. AI audit software helps auditors go through and make sense of large volumes of data in very little time. As touched on earlier, this increases an auditing team’s productivity and allows them to generate more accurate insights for the client.

According to a Sage research study published in early 2018, 66% of accountants said they would invest in AI to automate repetitive and time-consuming tasks. In 2022, as big data continues to surge, more accountants will likely agree.

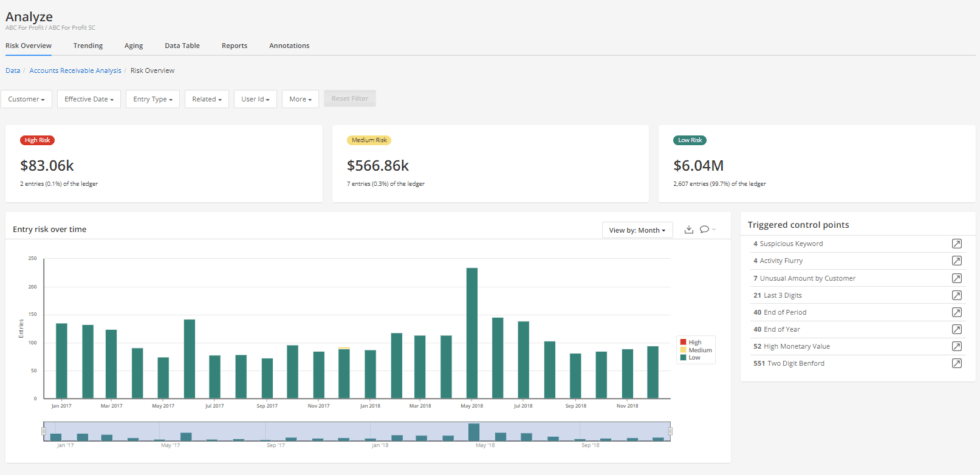

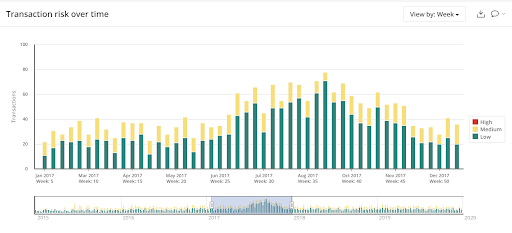

4. Greater need for risk assessment and fraud prevention

Risk assessment is a core component of every audit. However, a recent survey of peer reviewers found over half of 400 audits they reviewed were non-conforming because of non-compliance with the risk assessment standards (AU-C Sections 315 and 330).

In recent years, companies have been recognizing that fraud is a growing concern. In 2017, a vast majority of C-suite and other financial executives surveyed by KPMG believed that auditors should use bigger samples and more sophisticated technologies for gathering and analysing data. This year, the COVID-19 situation is said to potentially increase risks of material misstatement and fraud. Much of this involves concerns of financial pressures facing corporations and employees, as well as breakdowns in internal controls with remote work situations.

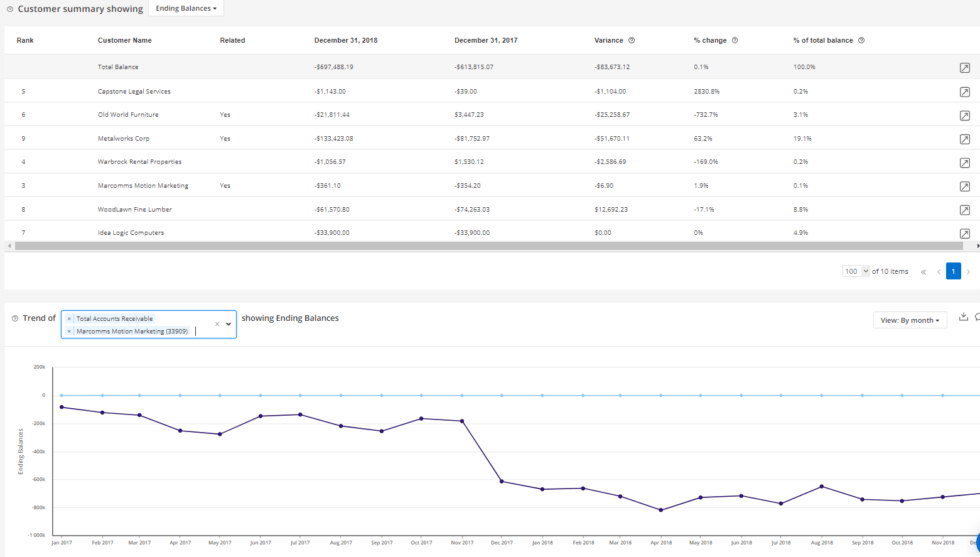

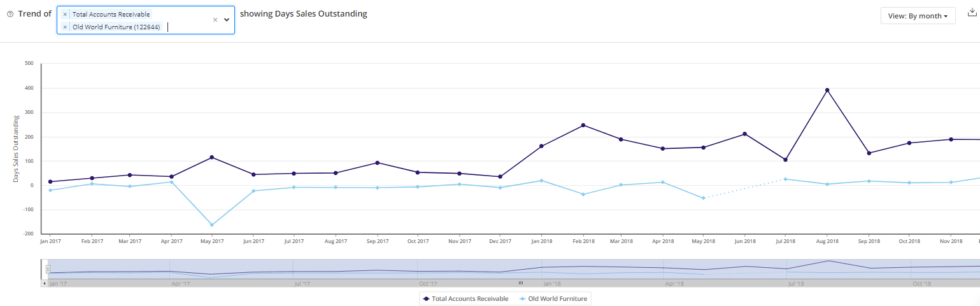

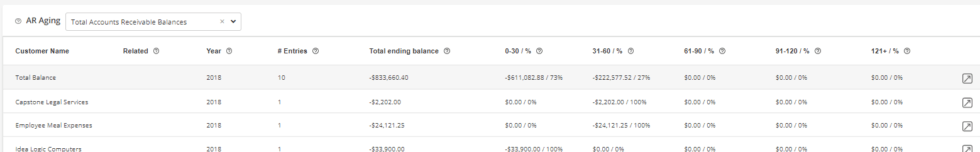

For 2021 fiscal year-end audits, auditors are in a unique position to tackle these risks head on using AI audit software. That’s because the audit software enables better fraud detection and risk assessment by testing and performing statistical analyses on 100% of a company’s financial data. With a higher likelihood of fraud looming this year, accountants could be more willing to put AI software to the test.

5. Opportunity for growing advisory services

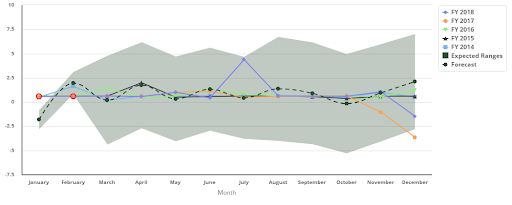

Traditionally, financial statement audits were driven by statistical sampling of past activities. But auditing practices as we know them are changing quickly. With access to more automated solutions, the future of auditing will likely involve real-time transaction analysis, risk evaluation, and data validation.

Using AI audit software today, an auditor can analyze the full scope of a company’s transactions and provide real-time insights regarding an organization’s risks and opportunities.

As we look ahead, auditors will likely be spending less time handling those manual, time-consuming audit procedures in 2022. Instead, auditing teams will have an opportunity to shift resources towards analyzing data, providing insights, and advising their clients. According to experts, a hybrid approach that combines the use of accounting technology and a focus on financial advisor input will continue to gain traction in the near future.

It’s time to capitalize on AI audit technology

While we can’t predict the future, we do know this— AI audit software will continue to help accountants and auditors gain deeper insights into their client’s financial data, in less time. Overall, the audit software can increase the efficiency of their processes, so they can focus on delivering better results. Those who are forward-thinking and ready to embrace artificial intelligence and audit technology will reap great benefits today, and tomorrow.

Ready to automate risk-based journal entry testing? Read this blog post from Solon Angel, Founder of MindBridge for some great advice.