Managing potential risks in financial data is a monumental task. But thanks to the latest digital audit tools and AI audit software, automation is now revolutionizing this domain. Here, we delve into the top 3 automated risk assessment tools that are making waves in the industry.

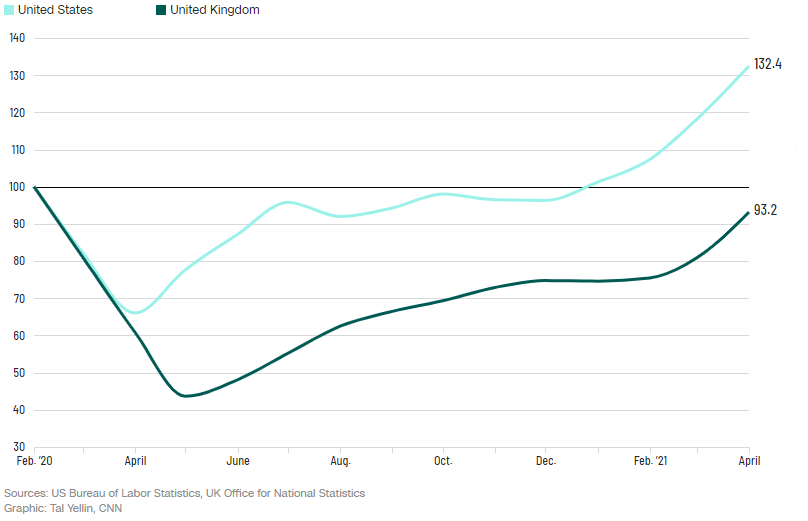

The adoption of new risk management processes has been a focal point of discussion in the business world generally. But, financial institutions are particularly focused, lately, on updating their procedures and processes in a post-pandemic, largely remote world. While pandemic talk may sound like a broken record at this point, it’s still an important consideration, even as the world becomes vaccinated and business begins to open up.

As businesses, we are not out of the woods yet.

Fortunately, new technologies spurred by automation are making it easier than ever for organizations to invest in more effective risk assessment tools.

As a report from Deloitte notes: “Latest technologies have the potential to fundamentally transform risk management. In addition to substantially reducing operating costs, these and other technologies can provide risk management with new capabilities including building controls directly into processes, prioritizing areas for testing and monitoring, deploying automated monitoring of limits with defined escalation, addressing issues in real-time to improve the enterprise-wide view of risk, and providing decision support.”

In addition to providing more efficient processes and a holistic view of risks facing an organization, improving the risk management function facilitates the detection and assessment of new risks that have emerged over the past decade. Cybersecurity, business model, and contagion risks are examples of some of the more recent risks that firms must now contend with. How an organization handles these risks can be the deciding factor on whether or not they sink or swim.

Kristina Davis, a partner with Deloitte Risk and Financial Advisory, explained in an article: “Organizations that proactively construct advanced risk management capabilities to keep pace with transformative change have the opportunity to gain competitive advantages.”

Wondering where to start with updating your risk assessment processes? Here are 3 top tools to help your organization automate risk assessment.

3 tools to automate risk assessment

LogicGate: GRC in the cloud

As LogicGate describes it, they’re creating more than just software – they’re creating peace of mind with their automated risk assessment tool.

LogicGate provides cloud software solutions for automating governance, risk, and compliance (GRC) processes through its Risk Cloud platform. The software empowers organizations to change disorganized risk and compliance processes into enhanced enterprise risk management operations that increase efficiencies.

What is GRC? According to CIO.com, GRC is a tailored way to align a company’s IT with business goals while also managing risk and meeting compliance obligations. In addition, a GRC framework can offer numerous benefits for organizations that take the time to implement one properly, such as better decision-making, improved IT investments, and the elimination of silos.

With LogicGate’s enterprise technology, process owners have full control with a no-code-needed app builder, pre-built templates, and the ability to craft workflows that suit their needs. The result is a customized solution that provides a comprehensive view of risk programs.

In an effort to make things even more flexible for users, the company recently expanded its integration offerings. LogicGate’s Risk Cloud now integrates with hundreds of platforms via the new Risk Cloud Connect, which works seamlessly with many core business systems, including Jira, Slack, DocuSign, and more.

“We’re on a mission to give risk and compliance professionals a single source of truth to make better, more informed decisions with their data,” said Jon Siegler, LogicGate’s chief product officer, in a press release.

Fusion Risk Management: Resilience meets efficiency

Fusion Risk Management originated as an idea scribbled by its co-founders on a restaurant tablecloth. Since then, it has become a well-respected cloud-based software solution focused on operational resilience, encompassing business continuity, risk management, IT risk, and crisis and incident management.

The company aims to help organizations anticipate, prepare, respond, and, perhaps most importantly, learn in any situation by providing them with the risk assessment tool to be successful. And because every organization is different, Fusion’s integrated suite of platform capabilities can be custom-tailored to fit a company’s unique needs.

Fusion’s products and services take organizations beyond legacy solutions, enabling them to make decisions backed by data with a flexible and inclusive approach to achieve operational resilience and mitigate risks.

Fusion’s flagship offering is the Fusion Framework System, which allows organizations to maintain resilience through a single platform, thereby eliminating the need for multiple disconnected modules across various risk areas. The company also recently launched Fusion Analytics, a new system capability that allows users to compile all relevant and required data into a single platform, which helps eliminate operational silos and foster collaboration by allowing teams to work together from anywhere.

“In today’s highly competitive market, businesses must demonstrate they have a robust operational resilience program and can make important, difficult decisions fast, at the speed of business. This especially holds true during times of market turbulence and volatility,” Brian Molk, Fusion’s Chief Product Officer, said in a press release.

MindBridge: The future of automated risk discovery

At MindBridge, we’re all about changing the world and creating a better future for all by improving the global financial system – one organization at a time.

Since our founding in 2015, MindBridge has become the world’s leading AI-powered risk discovery platform for financial integrity. We’re here to help auditors, accountants, and financial professionals become more efficient and successful.

From transactional risk reviews to organizational process improvements, MindBridge users have the AI-embedded tools, visualized analytics, and comprehensive resources needed for more robust and holistic analysis, assessments, and advisory services.

So, how does it work? MindBridge’s Ensemble AI technology compares data against 28 capabilities, or “control points,” to identify the level of risk in 100% of transactions in a given data set. The results far outweigh what would be achieved by running each capability separately, which is why more than 8,000 firms worldwide use MindBridge’s platform, including well-established institutions like the Bank of England and the Bank of Canada, and major firms such as Dixon-Hughes Goodman and Cherry Bekaert.

“Using MindBridge, we now have a standard way to do journal entry testing. And I feel a lot more confident about our selections now than almost any other method that we could come up with,” explained Jonathan Kraftchick, a partner with Cherry Bekaert LLP, of the firm’s adoption of MindBridge. “MindBridge is the future of auditing.”

And there you have it: 3 tools to automate risk assessment.

To read more on how other organizations have adopted MindBridge to improve their risk discovery, check out our case studies and customer stories.

To book a demonstration or hear from an expert, schedule some time with our team.