Commoditization has been a hot topic in the audit industry for some time now. We’ve heard from many prominent voices that commoditization is real – the invisible and somewhat mean-hand of the market driving prices down for audit as the only differentiator is price. But at the same time, we have been seeing average audit fees rise faster than inflation. For example, for a basket of US-listed entities, average audit fees increased from $6m in 2002 to over $15m by 2020, significantly outpacing inflation over the same period.

We’ve also seen significant evidence that price is not the only factor when choosing an audit firm. Of course, the expertise of the engagement team comes out number one, but increasingly the technological capabilities that firms can bring to bear are playing a key role.

Generally, it seems that firms that are responding faster to society’s rising expectations for efficient audits are reaping the benefits. Being able to win larger, more important, and more profitable audit clients is a key strategic advantage for these firms. However, at the larger end of the market, firms that are now unable to talk to their next-generation or data-driven audit are left with price as a remaining primary lever they must use to differentiate.

Of course, this is not always the case. A significant portion of buyers in the audit is still looking purely for the lowest price. The additional trust and credibility that auditors bring to financial statements today does not seem to carry much weight for this lowest price-focused buyer. For many such stakeholders, it is not easy to differentiate between a high and low-quality audit product. It is up to the audit firm to demonstrate that differentiation, and if undercutting is still a key strategy for an audit firm, then there is still a way to use technology to display how the level of assurance is not compromised despite the low price.

Thinking about the value proposition for a data-driven audit throughout the customer lifecycle is key to demonstrating this value.

Clear outcomes

Before speaking to value, having a clear set of outcomes for a data-driven audit approach is essential. Understanding how the service you are providing will change helps you effectively sell the value of this approach internally and externally. Defining these outcomes and understanding the differentiated value proposition that your firm offers is key.

1. Market facing

Even before you start talking to a prospective client, the firm must be communicating its outcomes in implementing a data-driven approach. Whether this is a lessened focus and effort on low risk-areas, more informed conversations with clients, or direct value-add, it’s critical to emphasize these factors to your market. Creating case studies, dedicating a section of your website for innovation, providing examples in newsletters, and aligning to accounting technology standards such as ISA315, SAS142, and SAS145 are great ways to raise awareness.

2. Proposals and tendering

Allowing your innovation and data team to have input into the proposal process is a step above, both in the form of a dedicated section in the proposal template as well as a process that allows the engagement team to demo the analytics capabilities during meetings. This demonstration could be done with demo-designed data or real data, depending on the importance of the proposal. It also offers technical and data-savvy staff an opportunity to get involved in this discussion with the client.

3. Planning and fieldwork

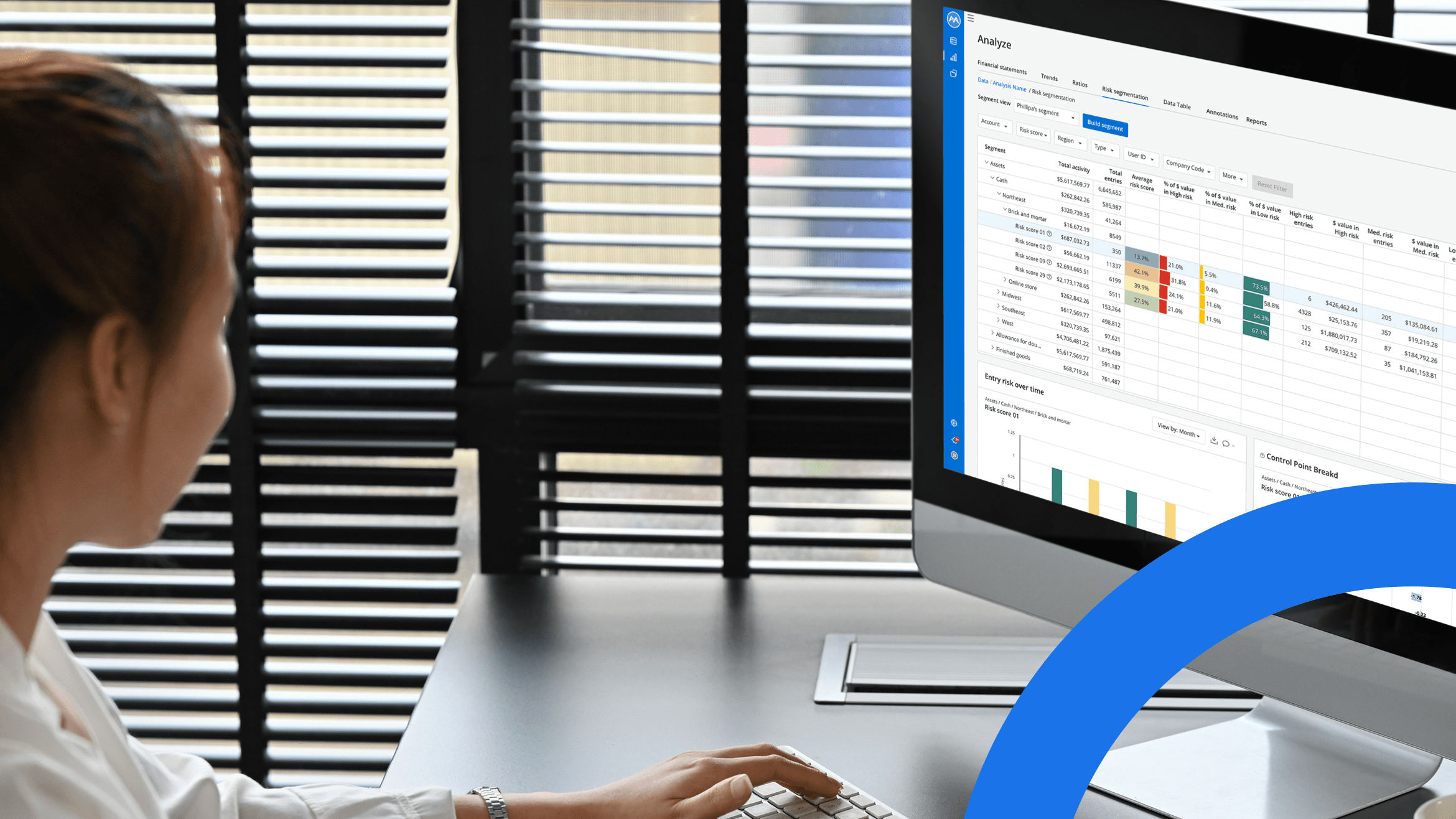

This audit stage centers around evidence gathering and learning from the auditor. Using data to deepen the engagement team’s understanding of the client can help with a far more productive conversation earlier in the audit process, but it is key that you’re demonstrating how you came to the conclusions you came to. Using visualizations during these conversations is a fantastic way to achieve this, and even better if you can navigate an analytics tool on the fly to adapt to where the conversation is going during the planning meeting.

4. Completion

Ultimately, it’s at this stage that the client sees most of the outputs for the audit process. As a result, we’ve found that including descriptive analytics is a fantastic way to add context to audit findings and cement a perception of value with your client.

Where to go from here? The pace of change in audit is accelerating, and there is a growing number of technologies that auditors can leverage in various ways. These are opening up strategic opportunities for firms to differentiate – but to do so means that they must be willing to take a different approach from their peers. So whether it is changing where the team is focusing on the audit, how they communicate with their client, or adding net new insights to the post-audit reporting, implementing technology is becoming mandatory as a differentiator and a means to deliver a more efficient audit.

For more information on how top accounting firms are driving growth with AI,

register now for our upcoming webinar with Cherry Bekaert.

This webinar will cover how Cherry Bekaert’s success with leveraging advanced data analytics for risk discovery has continued to offer more significant insights and more efficient audits.

Webinar: Improving audit efficiency by reducing sampling: The value of data-driven assurance