For the past few years, there has been real anxiety and fear that AI will replace auditors and accountants. Much of this debate started with a now-famous Oxford study cited in The Economist, finding accountants and auditors as the second most likely job to be automated within the next two decades – second only to telemarketers!

However, with the adoption of AI accelerating, we are also seeing increased demand for auditors from our client base. As a result, stories of increased pay packets for auditors are abounding, while at the same time, firms’ total headcounts continue to grow.

Future skills

It is no secret that audit firms have struggled to keep staff in the past. This is because audit has long been viewed as a training environment; one where staff picks up vital skills and understanding of business operations in order to take a step into the industry or some other professional service. The industry’s longstanding reliance on repetitive and manual audit techniques is part of this equation; no one enjoys the often endless ticking and tying.

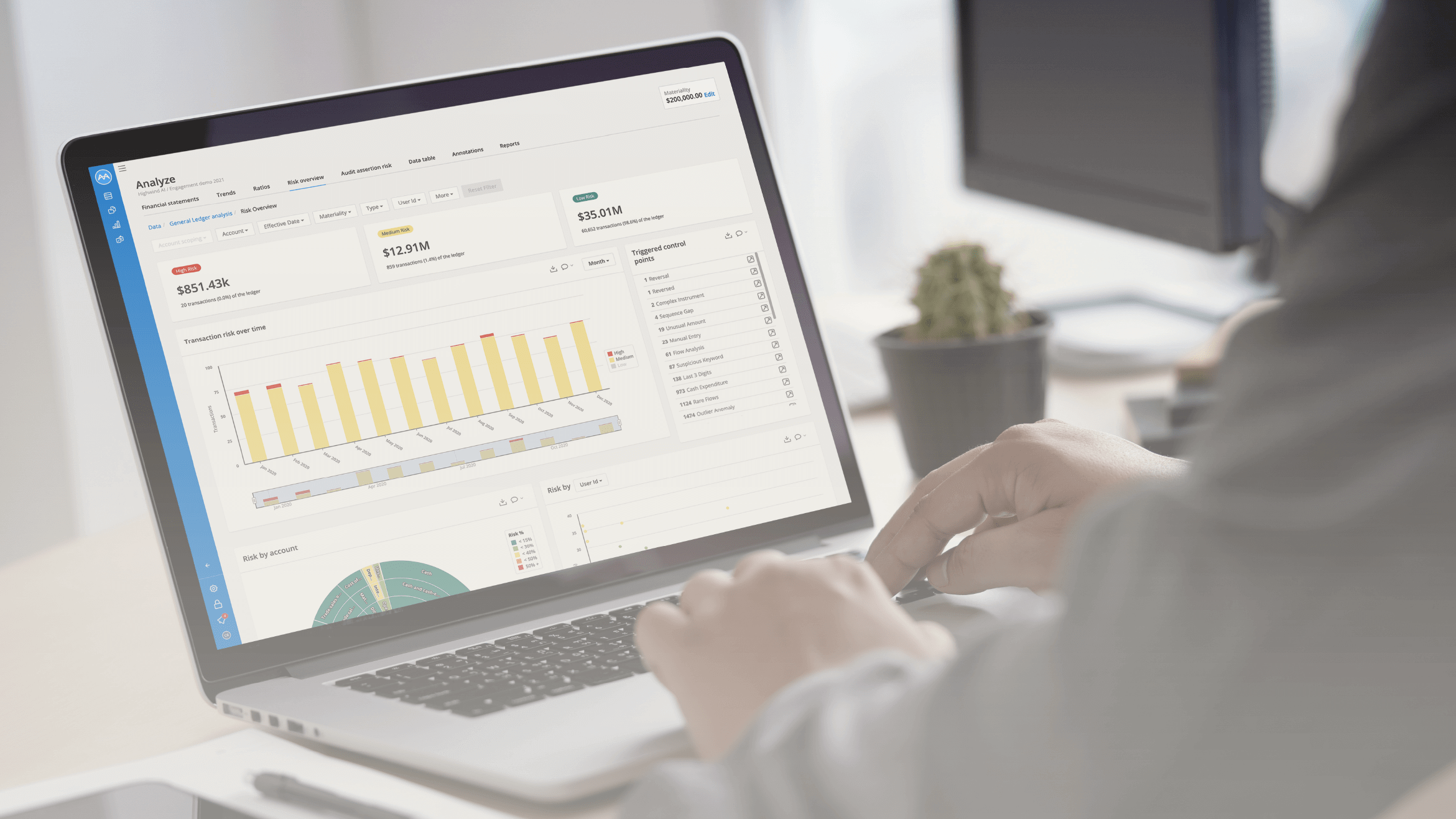

As Artificial Intelligence, enabled by new standards, is creating new opportunities for evidence generation, there is also an opportunity to reframe the skills that auditors can learn on the job. As data-driven techniques become core to today’s audit, auditors can now claim to be picking up both critical business skills and AI skills.

Training audit staff on how to use these tools will help them future-proof their careers and potentially increase the profit margins of jobs. This fact is supported by a survey from PWC, which found that 74% of firms that invested in upskilling employees’ tech capabilities saw an improvement in their talent retention.

Adoption of new technology allows smaller firms to attract new joiners, who otherwise may have been tempted to join the Big Four. Employees using AI tools will learn new skills needed by CFOs of the future and master tech-led audit processes. Tomorrow’s finance leaders will need to become comfortable using technology to perform data analysis to identify areas of risk and provide insights related to financial performance, so that audit will continue to be a fantastic springboard to senior positions in the industry.

The growing role of professional judgment

Such reliance on AI in place of traditional techniques creates a greater need for professional judgment. Auditors must now ask deep questions not just of the risk of material misstatement, but they must also pass judgment on the performance and applicability of data-driven techniques. When it comes to large-scale evidence generation, this is particularly important.

That’s not to say that auditors need to become full-blown data-scientists, just that they need sufficient skills to understand the strengths and weaknesses of any particular data-driven technique. In all honesty, this is not too far from the work auditors already do when designing testing; auditors have always been analysts. It’s just that they are quickly picking up techniques from the world of data science.

This creates an environment where auditors can sharpen their analytics skills to a much greater degree. Being able to ask great questions, both of the data and their clients (driven by the data), will lead to great auditors. Armed with the greater transparency that analytical techniques represent, conversations with customers become more conceptual, more targeted, and valuable for all those involved. All this means that audit is a great place to learn the skills of the future.

Auditors are entering the market with expectations around the tools they use and ways of working.

Those joining the profession have also come to expect clear and uncluttered user interfaces; the antithesis of the tools that dominated the profession during the earlier days of computerized auditing. Firms that understand how the software user experience impacts employee satisfaction will also do better at attracting and keeping the best staff.

Additionally, the education system has recently evolved, with university courses in accounting teaching how to implement new technology, data analytics, and cyber security. Companies like MindBridge, with their MindBridge University Program initiative, are partnering with educators to get students ready for the labor market. By not providing the latest tech, audit firms are creating a risk that potential employees choose to go to competitors instead.

Conclusion

While investing in new technology can be an effective strategy to help attract and retain staff, doing so also has commercial benefits for audit firms. This includes completing audits faster and more efficiently, alongside potentially reducing the cost of service delivery.

Expand your expertise, watch this short webinar from MindBridge here and learn how firms are adopting AI to drive growth.