Accounting software trends have impacted the accounting profession in big ways. And in my view, one of the greatest analogies of this impact, and even of the way our team at MindBridge delivers value to our clients, comes from Sam Daish, Head of AI and Data Science at Qrious.

A story of three types of businesses

In his previous role as General Manager of Data Innovation at Xero, Sam addressed a room full of very traditional big-firm accounting partners. During this talk, he described the evolution of manufacturing in the time when electricity was new. He summarized the journeys of three business types:

- Those who thought electricity was some strange wizardry and continued on as they always had

- Those who tried to adapt their processes around electricity to make things work

- Brand new businesses that sprung up native to electricity

Sam continued to tell the story of how manufacturing evolved in the 1880s. Businesses in the first category simply could not compete. They buried their heads in the sand. Their refusal to adapt was largely due to long-held pride in traditional expertise. The second group worked really hard to re-invent efficient processes—to make electricity bend and work around the way they’d always done things. The third set of businesses built operations with electricity at the heart. What happened to them?

- The ‘ostriches’ were completely obliterated by the rest of the market

- The ‘adapters’ really tried, but many businesses did not survive

- The ‘electricity natives’ absolutely consumed the market. They shifted customer expectations and quickly devoured customer relationships that were long-held by large, big-brand traditional businesses that once dominated the industry

The parallels with the accounting industry’s state of flux surrounding technology adoption are profound.

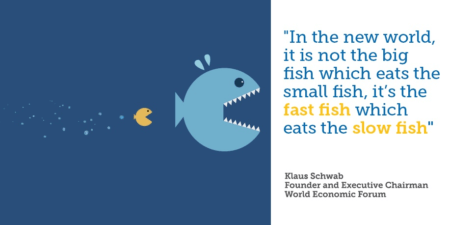

First comes cloud accounting software, then AI accounting software

At one point, there was so much fear, worry, and apprehension about cloud accounting software. Many believed the accounting software would steal jobs from bookkeepers, graduates, and accountants in general. Yet the only ones who have experienced any negative outcome have been those who failed to adopt and adapt. Accounting firms who have embraced cloud accounting software and the client-centricity of the single ledger, and who have assisted their clients in doing the same, are dominating the market. It is not accounting technology replacing accountants – it’s accountants adopting technology that are replacing those accountants who are not.

So what about AI now?

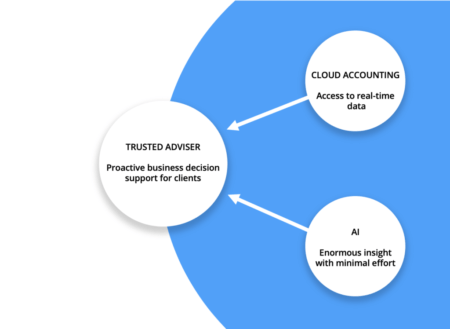

Most would agree that diversification into advisory services is the key to modernizing accounting firms and aligning with client expectations. During Covid-19 times, we have seen a reversion back to the bread-and-butter of compliance for many accountants. What we will see moving forward is the evolution of compliance; it will feel less like putting numbers in a box and filling out forms (as this becomes more and more automated over time) and more like compliance risk mitigation, or ‘compliance advisory’. So for the future-fit compliance and advisory firm, AI accounting software comes to the fore when we ask ourselves: “So you have access to all this real-time data via cloud—what are you doing with it?”

When we look at accounting software trends, the message to support the adoption of AI is like that of cloud: “AI—it’s about task replacement, not human replacement”. The automation and ‘task replacement’ we now enjoy with cloud accounting software is similar to AI accounting software—these technologies are just doing parts of the job which no one likes anyway. For example, we love presenting insights to clients, showcasing our deep expertise of industry, and offering fancy visualizations that break down the complex into a simple picture. But we don’t like entering or churning through the data to get to the insights. So for this, we have AI. In a recent Accounting Today article titled ‘What AI does for accountants’, the author describes three areas in which accountants can leverage AI accounting technology right now:

- Invisible accounting to automate reconciliations for clean, timely data

- Active insight to drive better decisions

- Continuous audit to build trust through better financial protection and control

Stepping towards success with AI

No matter where accounting firms are in their journey towards adopting new accounting software, one thing is clear—businesses need to, at the very least, start looking at the latest advancements in AI and all the advantages it offers, or risk being left behind. Some may be just jumping onto the cloud accounting software train. Others may begin courageously diving into AI. Regardless, there is a necessity for our established industry of accounting professionals to be deliberate about their re-learning journeys when it comes to accounting software. Those who seek to not only survive, but thrive, must ensure that data literacy and conceptual knowledge of what both cloud and AI accounting software can deliver are key to their business strategy moving forward.