The Big 4 are gobbling up all the new grads, and smaller firms are struggling to find the incredible talent coming out of accounting schools around the world. What can they do to set themselves apart, and tackle the beast of accounting staffing?

As countries around the world begin to emerge from the COVID-19 pandemic, small business owners and corporations are discussing ways for their employees to work in our new reality. Some have seen growth, some have struggled. But, beyond performance, COVID-19 has been a wake-up call for many, teaching business leaders the value of remote work, and expanding their talent pool.

Accounting firms are continuing to analyze and assess the performance of remote workers, client satisfaction, and more to determine the best way forward.

It seems like this would be a great time to hire additional workers, right? Or, at least to review hiring processes, staffing, and other recruitment initiatives.

Well, it certainly would be if there were workers available. Unfortunately for the accounting realm, we are facing a severe global skills shortage.

It’s not just the finance sector that is struggling to find workers, though. Around the world, numerous industries are grappling with an unprecedented talent deficit.

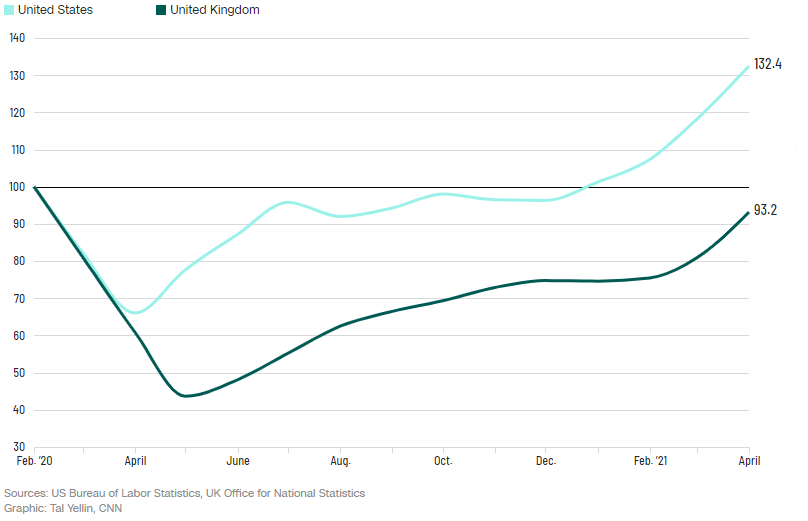

In the United States, there were a record 9.3 million job openings in April 2021, while the United Kingdom saw advertised job vacancies jump 45% between the end of March and mid-June. So, it goes without saying that the competition for retaining and acquiring talented workers is fierce.

While higher wages might seem like the easiest answer, it’s not quite that simple.

The challenges of accounting staffing

A persistent skills gap

It’s no secret that job openings and required skills in the accounting industry aren’t the same as they used to be. While there is vast potential with the continual adoption of financial technology and tools, finding talent with the appropriate skill set to fully utilize said tools is challenging. On top of that, recruiters focusing on accounting staffing have to compete for talent against industry competitors like the Big 4, as well as various tech companies.

An adept ability to crunch numbers and implement Excel formulas used to suffice for a job in finance. However, as technologies have evolved and many innovative tools can now automate rote and tedious tasks like these, accounting firms are expanding their expectations to include digital skills such as data analytics and business modelling in candidates. However, the academic side of the equation has struggled to keep up to the evolving industry by offering an accounting curriculum that covers these ‘new’ skill sets.

And therein lies a major crux of the skills gap plaguing the accounting industry: bridging the gap between academic and workforce expectations for new accounting graduates. Today’s students will become tomorrow’s accountants. As such, they need to be prepared for real world situations, which increasingly includes using and understanding the tools that are reshaping their roles, and the larger finance sector.

Retention struggles

Recruitment isn’t the only staffing issue the accounting sector is wrestling with. Retention has been a struggle for the financial industry since the 2007 financial crisis.

As an article from Thomson Reuters put it: “High turnover rates have practically become synonymous with accounting firms, sometimes reaching up to 30% at large audit firms.”

According to the latest Inside Public Accounting annual survey, staff turnover averaged 13.7% across all accounting firms, with the most significant increase in turnover rates from firms in the $10 million to $30 million range.

There is also another retention threat looming on the horizon. As COVID-19 restrictions ease, ‘The Great Resignation’ is an emerging employment hurdle that companies will need to grapple with.

“According to a recent report by job site Monster.com, a staggering 95% of workers are considering changing jobs, and 92% are willing to switch industries to find the right position.”

There is some good news when it comes to lowering turnover rates, though. The ability to improve employee retention rests almost entirely in the employer’s control.

How to address accounting staffing issues

The remote work conundrum

Even as things return to “normal,” work will never be the way it was pre-pandemic.

Zoom meetings and PJs have become our new norm. As a result, people have become accustomed to the flexibility of remote work. Many enjoy being able to grab groceries in the middle of the day, take an afternoon break to go for a run, or pick up their kids from school without having to worry about being absent from the office. So, it’s not surprising that many are resisting going back to the nine-to-five grind.

“The EY 2021 Work Reimagined Employee Survey found that more than half (54%) of employees surveyed worldwide would quit their job if they aren’t offered enough post-pandemic flexibility on when and where they work.”

“Flexible working is the new currency for attracting and retaining top talent,” noted Liz Fealy, who leads EY’s global workforce advisory group. Interestingly enough, many firms are still considering returning to brick and mortar offices.

According to AccountingToday, 61% of accountants plan to keep their current brick and mortar office footprint. Though, many have cited that this workspace will primarily be used for client meetings, training sessions, and other administrative work.

So, as you can see, the future of accounting staffing seems to depend on who you ask.

However, having a company plan for full remote or hybrid work models goes far beyond the immediate post-pandemic return-to-work response.

A PwC report on the Canadian workforce found that financial services employees have a higher preference for remote working than any other industry the survey measured. 58% of financial services employees say their ideal workplace is entirely or mostly remote, compared to 34% for employees surveyed across all industries.

“In addition to retaining current talent, flexible work arrangements are paramount to attracting new talent from the Gen Z workforce. In a survey of Gen Zers by the Association of Chartered Certified Accountants (ACCA), 23% listed flexible working arrangements/working from home as being one of their top five attractions for employment”

All of this isn’t to say that remote work is a perfect or easy solution. Far from it. It also doesn’t suit every person or every position. Then, how do companies deal with remote work arrangements moving forward?

For starters, being open and transparent and asking employees for input on what they need and want going forward. This includes ensuring they have the right tools that not only enable but also enhance remote work. For example, tools utilizing artificial intelligence (AI) and automation are beneficial in helping workers maintain productivity and collaboration outside of the traditional office space.

Investing in upskilling

People are a company’s greatest asset. But, the need to invest in that asset is often forgotten.

Organizations that have invested in upskilling their employees’ tech capabilities have seen the return on investment: one survey from PwC found that 74% of those who reported an improvement in talent retention and recruitment because of digital investments said “the level of improvement met what was expected or even more.” What’s more, CEOs who have made investments in their upskilling programs are more optimistic about their company’s growth prospects than those who haven’t.

From an ACCA report, 49% of Gen Z respondents ranked “opportunities to continually acquire new capabilities/learning” as one of their top five attractions for employment – more than any other factor listed. The report also notes that eagerness to learn, combined with Gen Z being “’fantastic ambassadors and early adopters’ of tech … could help the rest of the business adopt digital.” In fact, 91% of Gen Zers said they expect to update their capabilities continually to remain employable in the future. Younger generations are more than willing to learn new skills, and it’s up to organizations to capitalize on the opportunity.

What’s more, an upskilling program is one way that companies can overcome the very same, growing skills gap affecting the accounting industry today.

Firms need to realize that the “old-school” accounting skill set won’t suffice. Investing in new technologies and exploring different ways of working must be prioritized for every accounting organization. A case in point: 82% of financial services employees believe upskilling would improve their job performance.

Moreover, younger generations like millennials and Gen Z believe that technology can make them more effective at work. Many even feel constrained by what they view as “outdated traditional working practices.” Younger employees entering the accounting workforce have no desire to plug numbers into Excel for hours on end. They want the skills and ability to use the latest technology that is rapidly changing the industry.

Of course, the onus isn’t on accounting firms alone. As was noted earlier, there is a need to ensure that the academic curriculum is adequately preparing new graduates for the accounting work they will undertake in the field, including using AI and automation technologies that are becoming all the more prevalent in accounting. That’s why many organizations, including MindBridge, are committed to helping students receive hands-on training with new technologies by bringing AI and data analytics into the classroom.

Embracing technology

Investment in technology is the common theme for solving the shortages in accounting staffing.

We’ve said it before, but it’s worth repeating: it is not accounting technology replacing accountants – it’s accountants adopting technology that are replacing those who are not. As we say at MindBridge, while our technology may be AI-embedded, it’s human-powered.

Technology like AI and automation is becoming the new norm in the accounting industry. Firms that embrace and invest in these innovations are the ones who will continue to thrive — both in terms of attracting clients and employees. Firms that invest in technology are far more likely to recruit new and upcoming talent while retaining existing staff by differentiation from the thousands of other firms in the market vying for the same qualifications.

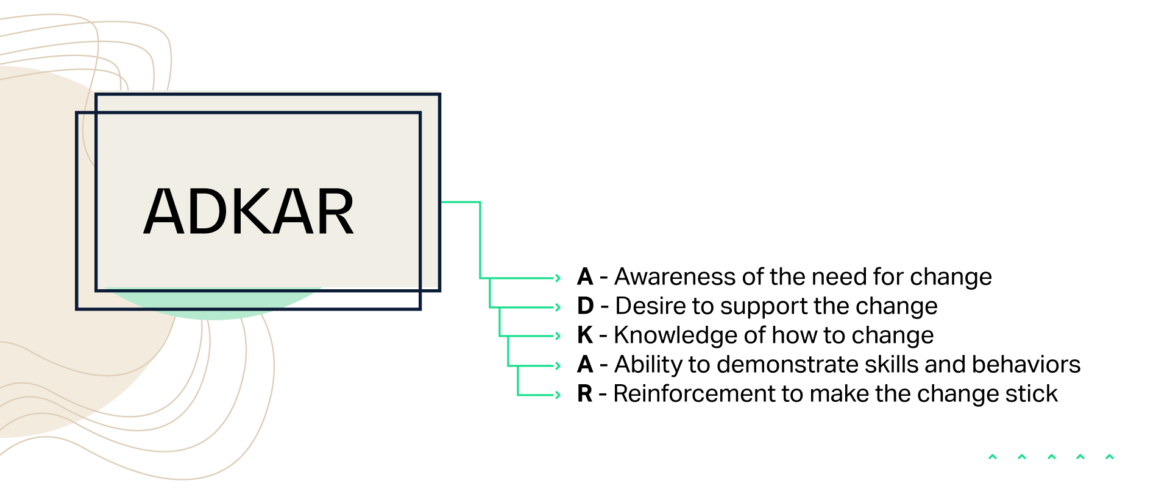

Of course, implementing new technology into your business practice doesn’t happen overnight, and it’s a process that may require brushing up on some change management best practices. But finance teams need to start investing now in long-term solutions that will position them and their workers for success. Because just like remote work, AI and automation are here to stay.

For more articles like this one, visit our blog.

To learn more about how the MindBridge Audit Approach can benefit your firm, download our briefing paper.