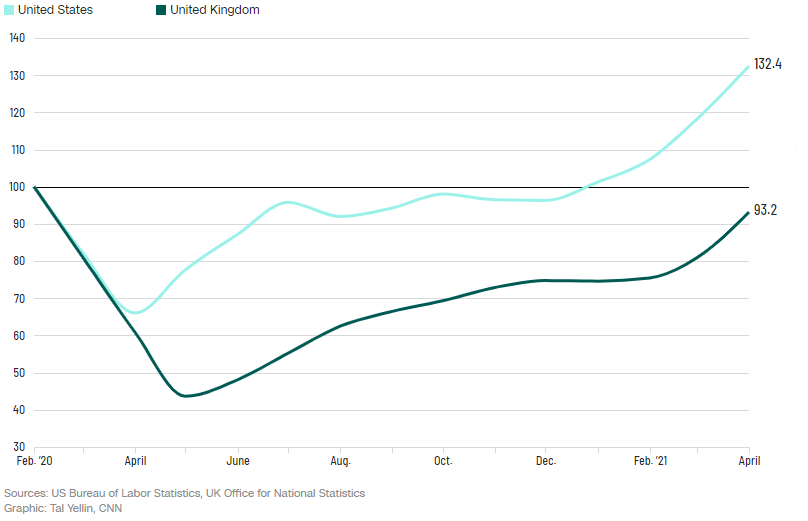

Every business in every industry right across the world has had massive challenges over the last 16 months. There’s nothing ‘standard’ about our standard operating procedures anymore. Almost every business has been forced to adapt – and those that haven’t been forced have definitely given more thought to business continuity, business risks, and threats to their operating model.

Lately, it seems necessary to become comfortable with change, and we are also seeing a willingness to pivot. The idea that we get up, go to work, and come home is not the same as it was pre-March 2020, and likely will never be.

For the accounting industry, the pandemic has exacerbated the talent challenges we traditionally face:

- International travel restrictions prevent us from accessing secondee resources

- Post busy-season burnout is now more prevalent, with reporting deadline extensions removing any workflow troughs that were once a saving grace

- What was previously an ‘earned privilege’ – working from home and general work flexibility – is now a day one baseline expectation

- Because challenges are profession-wide, we’re losing more and more talent to commercial roles in the industry, as qualified professionals start the path to CFO, where, let’s face it, the pay and recognition are better than we’re used to delivering in our accounting firms

We absolutely do have a pipeline issue, no doubt. Many students are enticed away from accounting studies into bright shiny STEM subjects at university. We also have a persistent gap between the skills we’d love in our team and the skills we have today in the workforce. There are not enough data and tech savvy unicorn accountants to go around.

But our immediate challenge is in simply getting the work done: we do not have enough people!

- Back in 2015, the AICPA estimated that 75% of its members would be eligible to retire in 2020

- Almost one third of UK firms are struggling to recruit

- In NZ, the reporting deadlines have been extended by 2 months

- The Australian government recently added accountants and auditors to the Priority Migration Skilled Occupation List (PSMOL)

The laws of supply and demand are in full swing. Salary expectations are through the roof, with the Big 4 and even large mid-tiers poaching any senior staff they can get, offering massive salaries and signing bonuses. We need people in our firms like we all need oxygen.

But what if there was a readily available talent pool that we’ve overlooked in the past? A talent pool that could not only assist with our acute capacity issues today, but could build resilience within our teams, even support our brands becoming employers of choice. We should all go for it, right?

What is the Career Cliff?

We’re all likely familiar with the glass ceiling – an unacknowledged barrier to advancement in a profession, especially affecting women and minorities. What worldwide data shows us, is that not only is advancement in our firms challenging for women, but that our profession is losing women all together – a career cliff, if you like.

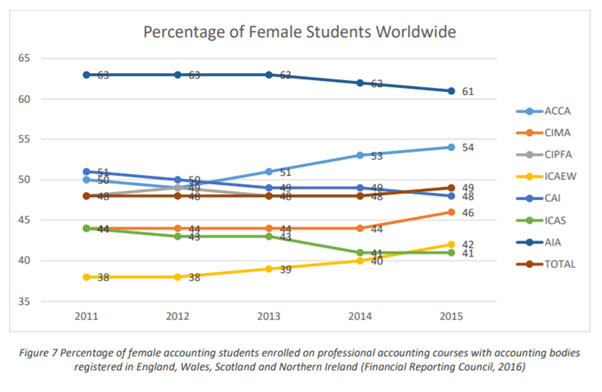

Very consistently across the globe we see gender parity in our graduates of accounting and finance degrees, for example, as reported by the Financial Reporting Council below.

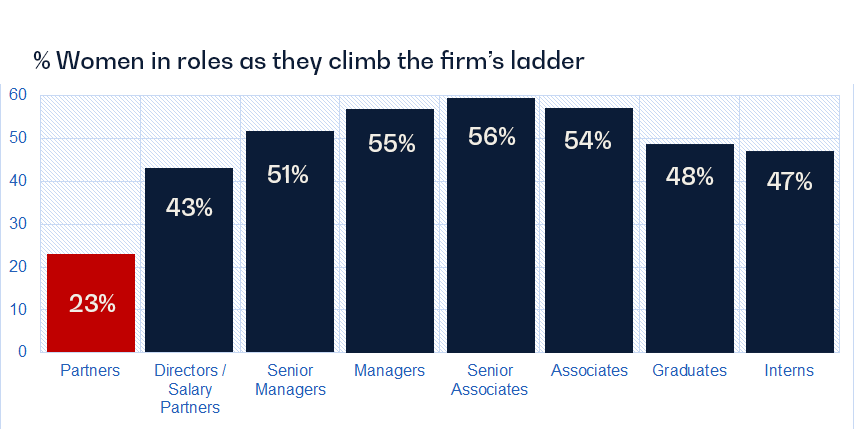

But by the time our graduates progress to their mid-career level, we start to lose women from our firms. On average, we are able to maintain a nice even mix through Associate and Manager levels only to see our women suddenly fall from the career cliff, with only half still remaining at Partner level.

Source:

https://www.aicpa.org/content/dam/aicpa/career/womenintheprofession/downloadabledocuments/2019-cpa-firm-gender-survey.pdf

Where do all the women go? Perhaps the more relevant question is – WHY do all the women go?

A Handful of Whys

Across global geographies, accounting industry membership bodies and regulatory authorities regularly report on all elements of the profession, including remuneration and diversity of representation. Consistently, all of these bodies confirm evidence of a gender pay gap, the mere existence of which is discouraging to the plight of ambitious women in our industry: :

- For CAs in Australia, the gender pay gap is $50k, and New Zealand $60k

- In the US, female accountants and auditors are paid $20k less than male colleagues

- And in the UK, female chartered and certified accountants earn around £5.5k less than their male colleagues

In addition to this, and discouragingly, the same data also indicates that the majority of men in the industry believe that the gender pay gap is a myth.

“70 percent of male respondents don’t think this issue exists”

source: CA ANZ 2021 Remuneration Survey

As Marian Wright Edelton said “you can’t be what you can’t see,” and our industry has significantly lower representation of women in senior leadership. The AICPA’s 2019 US CPA Firm Gender Survey, data collected by the Australian Financial Review and the UK’s Top 50+50 survey all confirm roughly an 80:20 split of male and female partners in our firms. So after achieving parity at most levels of the firm as team members progress, once women reach director and partner level – off the career cliff they tumble.

Women frequently leave our esteemed profession because they don’t believe they can achieve the balance and workplace flexibility they need to perform at their A-Game at work and in life. Whatever the reason, the traditional commute and requirement to be physically in the office can significantly affect balance, happiness, and even productivity. So we see women leaving our firms. Some start their own consultancy. Some leave the profession altogether.

The Opportunity

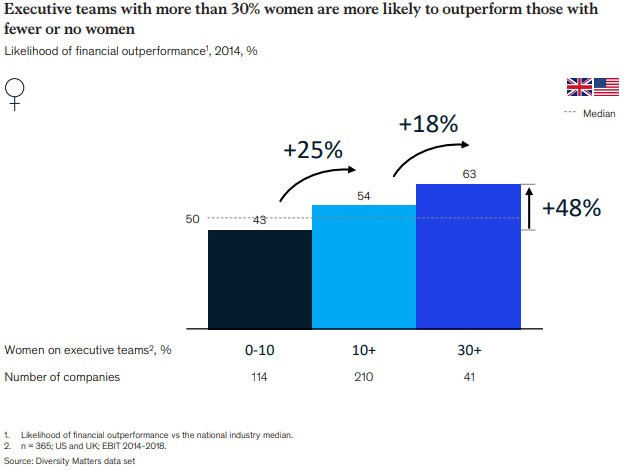

Gender and moral obligation aside, increasing diversity in our firms is proven to be a sound business strategy resulting in significant commercial outcomes. McKinsey’s most recent Delivering Through Diversity report found that firms that embrace diversity on their executive teams:

- were more competitive, and

- 21% more likely to experience above-average profitability

Encouragingly, there are also wins in the journey, rewards for all efforts, with research showing that financial performance increases in line with increased diversity in leadership.

Source: McKinsey – Diversity Wins: How inclusion matters

We have the opportunity to access the critical capacity we need right now and build resilience in our talent succession pipelines when we work deliberately to entice women back to our firms and help them bridge the career cliff.

But how?

A classic accounting adage – “what gets measured gets done.” Our competitors have an advantage if anyone in our firm perceives that they’re underpaid. We can mitigate this perception by performing regular gender pay audits to identify inequities and make the necessary corrections. In the UK, mandatory gender pay gap reporting is creating an awareness and accountability loop that has had a real impact since its introduction in 2017 – with the gender pay gap closing by almost 20% across the reporting group.

We should be proud about our ambitions for diversity and inclusion, so let’s set targets and publicise why diversity is important for our firms and the profession in general. The AICPA Survey reported only 6% of US firms surveyed have a formal gender component embedded in their succession plans. And, so for our firms that adopt this deliberate and transparent action, this is a huge opportunity to attract top female talent. Julie McKay, partner and chief diversity, inclusion and wellbeing officer at PWC Australia, said recently “Targets have assisted the firm to move from 19% women in the partnership in 2016 to more than 30% in 2021.”

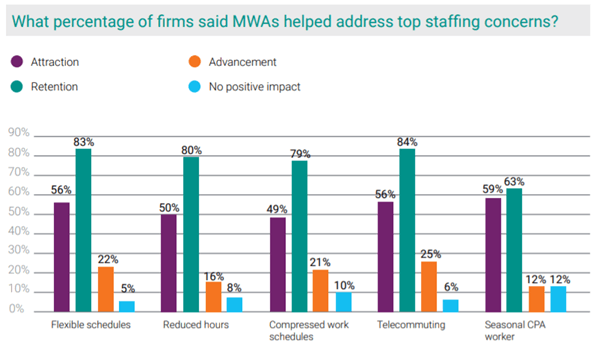

Today’s workforce, regardless of gender, expects workplace flexibility. US firms supporting flexible work arrangements reported the significant impacts on attraction and retention of all staff…and this was pre-Covid!

Supporting workplace flexibility that allows all team members, but especially women to better balance the demands of their home life with work is mission-critical to attracting, retaining and promoting women in our firms..

In a Covid-induced state of flux, the landscape is perfect to shift the way we think about retaining talent in our firms. In particular, the way we retain, promote and win-back women.

At MindBridge, we’re passionate about empowering future female leaders of STEM. Through our HERoes program, we’re engaging women to change the future of the technology industry.

Read more about the MindBridge HERoes program HERE.