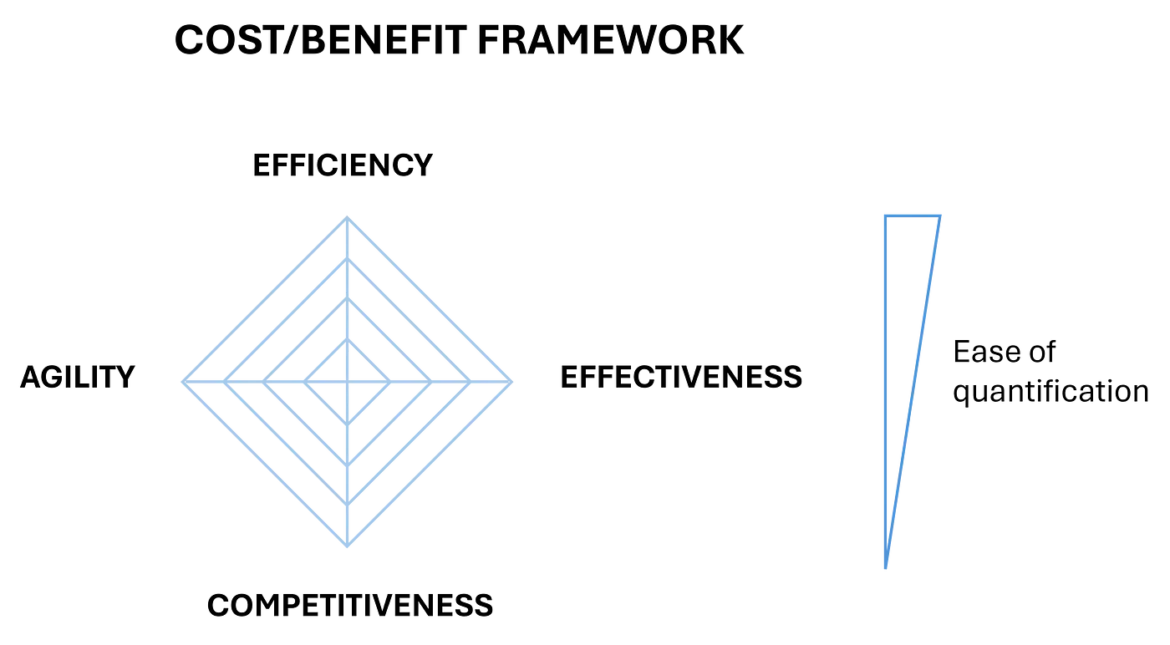

Return on investment (ROI) is critical in technology investment decision-making. It is primarily quantified by setting the total cost of ownership in relation to cost savings and improved business outcomes measured in $ resulting from efficiencies and where quantifiable increased effectiveness. The calculation of these metrics results in a clear business case that models time to break even and ROI (Return on investment). While this approach is valid and widely deployed, it does not capture the value that is created by a potential increase in not (easily) quantifiable dimensions of effectiveness, agility, and competitiveness.

At present, this puts many decision-makers responsible for AI adoption in a conundrum: While many are convinced that AI will fundamentally change how we do business, many AI tools do not provide a convincing ROI based on readily quantifiable efficiency gains alone.

In this article, I want to share my thoughts on an ROI framework that helps to take a more holistic view of ROI by extending it to a cost/benefit analysis that takes value beyond $-gains into account.

Readily quantifiable $-returns: Efficiency and (some forms of) effectiveness

The principal drivers of ROI in technology investments are:

- Efficiencies: Dollars saved, often by streamlining processes and reducing operational costs

- Effectiveness: Dollars gained through enhanced business outcomes, such as increased sales, improved customer satisfaction, or higher productivity.

These quantifiable benefits are straightforward inputs into a business case and ROI calculation.

Hard-to-quantify benefits: Agility, competitiveness, and (some forms of) effectiveness

While efficiencies are important, investments in AI often offer further, significant, albeit harder to quantify, benefits:

- Agility: The ability to adapt swiftly to changing business needs.

- Competitiveness: Achieving mid- to long-term competitive advantages that enable outperformance of rivals.

- Effectiveness: There are many forms of increased effectiveness that are hard to quantify. Reduced business risk will in many cases be hard to quantify.

These benefits are instrumental for a company’s long-term success, ensuring its competitiveness and adaptability in the market. At the same time, predicting and quantifying these benefits can be challenging.

Examples of hard-to-quantify benefits

Intangible and hard-to-quantify benefits can drive substantial value for businesses. Examples include:

- A reduced number of errors.

- A more skilled and motivated workforce.

- An improved ability to respond to changes and challenges.

- Higher probability of developing competitive advantages over time.

- Reduced business risk, increased assurance

While it is intuitive that these benefits will drive business performance and translate to increased revenues and/or profits, quantifying them as part of a business case is too speculative and too dependent on assumptions that most professionals will not feel comfortable putting $-values on them. Therefore, they are not included in ROI quantifications.

Financial technology: A focus on efficiency

Finance departments are typically run as cost centers. The “classic” investment in financial technology focuses on automating and integrating financial processes, leading to streamlined operations and cost savings. These investments usually present clear efficiency-based ROI calculations.

The value proposition of AI technology in finance

Artificial Intelligence (AI) brings a unique value proposition that typically extends beyond efficiencies, including

- Efficiency: AI assists humans in tasks and plays a significant role in automation, leading to cost savings.

- Effectiveness: AI enhances business outcomes by scaling human capabilities and output and providing new capabilities.

- Agility: AI provides deeper insights and enables quicker adaptation to market changes and emerging opportunities.

- Competitiveness: AI can provide strategic advantages that help companies outperform their rivals.

The discrepancy between the efficiency-based ROI analysis finance departments typically deploy vs. the full cost/benefit proposition of many AI tools is obvious.

Strategic imperative: Investing in AI

AI is expected to be fundamentally disruptive across all business functions. Building capabilities, knowledge, and processes around AI deployment and use is a strategic imperative. Companies must recognize that while AI investments can improve efficiency, their full value often lies in their potential to enhance effectiveness, agility, and competitiveness.

At the same time, the exact use cases, capabilities, and implementations that will bring the most value to an entity will often be specific to the industry, company, and use case.

Therefore, it is important to develop expertise around AI, explore, and start the journey to finding the specific AI tooling and deployment that unlocks the most value for the organization.

Rethinking AI investment strategies

- Many of today’s emerging AI tools might not provide a convincing ROI if evaluated solely on efficiency gains. Therefore, investment decisions should be based on more holistic cost/benefit considerations that value tools impact on effectiveness, agility, and competitiveness.

- Given the broader benefits and strategic importance of AI, companies should consider establishing “strategic investment” budgets specifically for AI. This helps to provide funding for investments that do not provide a short-term ROI based on efficiency-based business cases.

Recommendations for AI investment

- Holistic cost/benefit analysis: Rather than focusing narrowly on dollar-based ROI calculations, companies should perform cost/benefit analyses that include both quantifiable ROI and non-quantifiable benefits.

- Strategic investment budgets: Given the broader benefits of AI, companies should consider establishing “strategic investment” budgets specifically for AI. This helps to provide funding for investments that do not provide a short-term ROI based on efficiency-based business cases.

- AI adoption strategy: Develop and fund the enterprise’s cross-functional AI adoption strategy. This plan should seek to promote experimentation, learning, and development of AI deployments that drive short to long-term value.

Conclusion

Technology investments, particularly in AI, should not be evaluated purely on traditional efficiency metrics. While efficiency is important, the strategic benefits of effectiveness, agility, and competitiveness are equally critical for long-term success. By adopting a more comprehensive approach to cost/benefit analysis, companies can better leverage the transformative potential of AI and other technologies, ensuring they remain competitive in an ever-evolving business landscape.

Portions of this article have been informed by or edited by AI tool(s) and have been reviewed, edited, and clarified by my team and myself.

About the author: Matthias Steinberg is CFO of MindBridge.ai, a leader in AI driven financial risk discovery. Previously he was CFO of IONOS, Europe’s largest mass market hosting provider where he oversaw a multi-year effort to ready the company for its IPO. In the process, he developed an interest in AI technologies to transform risk management and assurance in the Enterprise.