Financial scandals are dominating headlines with increasing frequency, affecting organizations of all sizes—from multinational corporations to fast growing startups. No company is immune to the risks of fraud or financial reporting errors. The consequences go far beyond financial losses; they undermine trust, tarnish reputations, and shake investor confidence. No business wants its name associated with these damaging stories.

Instead of asking, “Who’s to blame?” when fraud is uncovered, the better question is, “What allowed this to go unnoticed?” In today’s fast-paced, data-driven world, traditional detection methods often fall short. That’s why it’s critical for management, internal auditors, and external auditors to work together—armed with the right tools—to detect and prevent fraud before it escalates.

Understanding financial reporting fraud

One of the most concerning types of fraud is financial reporting fraud. This happens when accounting records are manipulated to paint a misleading picture of a company’s financial health. It may not involve direct theft, but the consequences can be just as devastating—misleading stakeholders, distorting financial statements, and eroding trust.

Fraudulent financial reporting mechanisms often include:

-

- Capitalizing operating expenses on the balance sheet to avoid impacting profits.

-

- Creating fictitious prepaid expenses.

-

- Misclassifying intercompany charges to avoid scrutiny.

-

- Recognizing offsets to revenue to improve financial optics.

-

- Reclassifying operating costs as inventory expenses to hide true expenses.

-

- Manipulating accruals to change the timing of cost recognition.

As companies handle increasingly complex financial transactions, the risk of these practices going undetected grows.

Why traditional detection falls short

Traditionally, detecting irregularities meant sifting through accounting entries manually—especially those recorded near period-end. Reviewers of these entries typically look for things like:

-

- Missing documentation or unusual approval patterns.

-

- Suspicious offsets between unrelated accounts (like debiting fixed assets while crediting expenses).

But let’s be honest: in today’s data-driven world, this just isn’t enough. Companies produce mountains of accounting data, and relying on human reviewers to analyze every entry is unreasonable. Critical red flags can easily slip through the cracks.

The role of AI in fraud detection

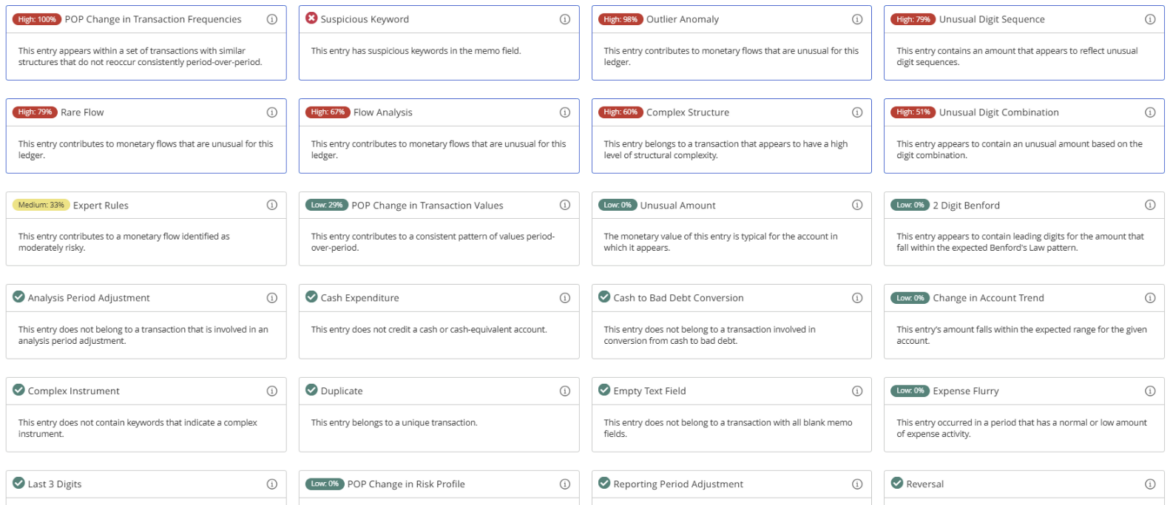

Traditional fraud detection methods can’t keep up with the sheer scale and complexity of today’s accounting data. This is where AI-powered tools like MindBridge come in. Unlike manual reviews, MindBridge algorithms analyze 100% of ledger entries with unmatched precision, flagging potential red flags that humans might miss. Here’s a glimpse:

-

- Fabricated entries

MindBridge uses Benford’s Law to catch entries with suspiciously fabricated amounts—ones that just don’t follow the expected frequency patterns.

- Fabricated entries

-

- Backdated or unusual journal entries

Identify entries posted outside regular working hours or backdated to earlier periods.

- Backdated or unusual journal entries

-

- Unusually large or round-number entries

Spot transactions that stand out due to their size or round-number patterns, which may indicate manipulation.

- Unusually large or round-number entries

-

- Last-minute adjustments

Highlight consistent and late adjustments made right before financial close, which can often conceal irregularities.

- Last-minute adjustments

-

- Account entry deviations

Detect accounting entries that differ significantly in amount, timing, or frequency compared to the rest of the ledger population—something manual reviews can’t achieve.

- Account entry deviations

-

- Recurring entries avoiding the P&L

Flag entries in accounts specifically designed to bypass the profit and loss statement.

- Recurring entries avoiding the P&L

-

- Unexpected account interactions

Surface rare or unusual relationships between accounts, which may point to intentional misclassification.

- Unexpected account interactions

-

- Abnormal activity in expense accounts

Highlight irregularities in expense accounts, such as spikes or inconsistencies, that don’t align with typical trends.

- Abnormal activity in expense accounts

-

- Expert scoring

Use scoring models built by experienced auditors to identify improper account interactions or entries.

- Expert scoring

In addition, MindBridge offers powerful features to make fraud detection even more effective:

-

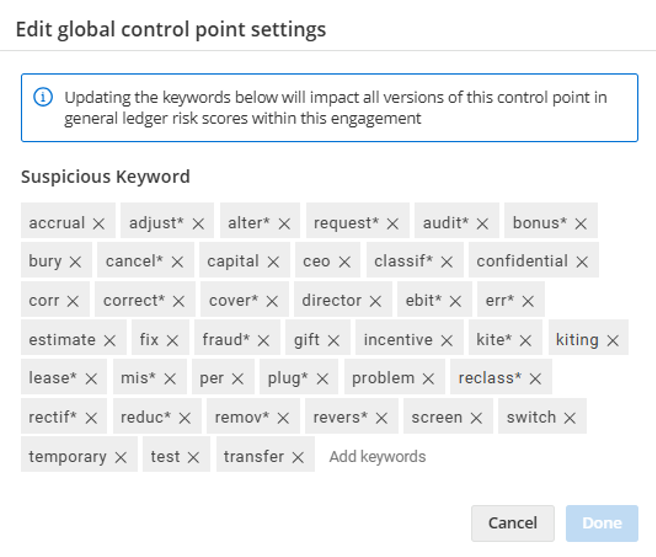

- Keyword searches

Scan journal entry descriptions for terms like “adjustment,” “correction,” or “override” and flag these for review.

- Keyword searches

-

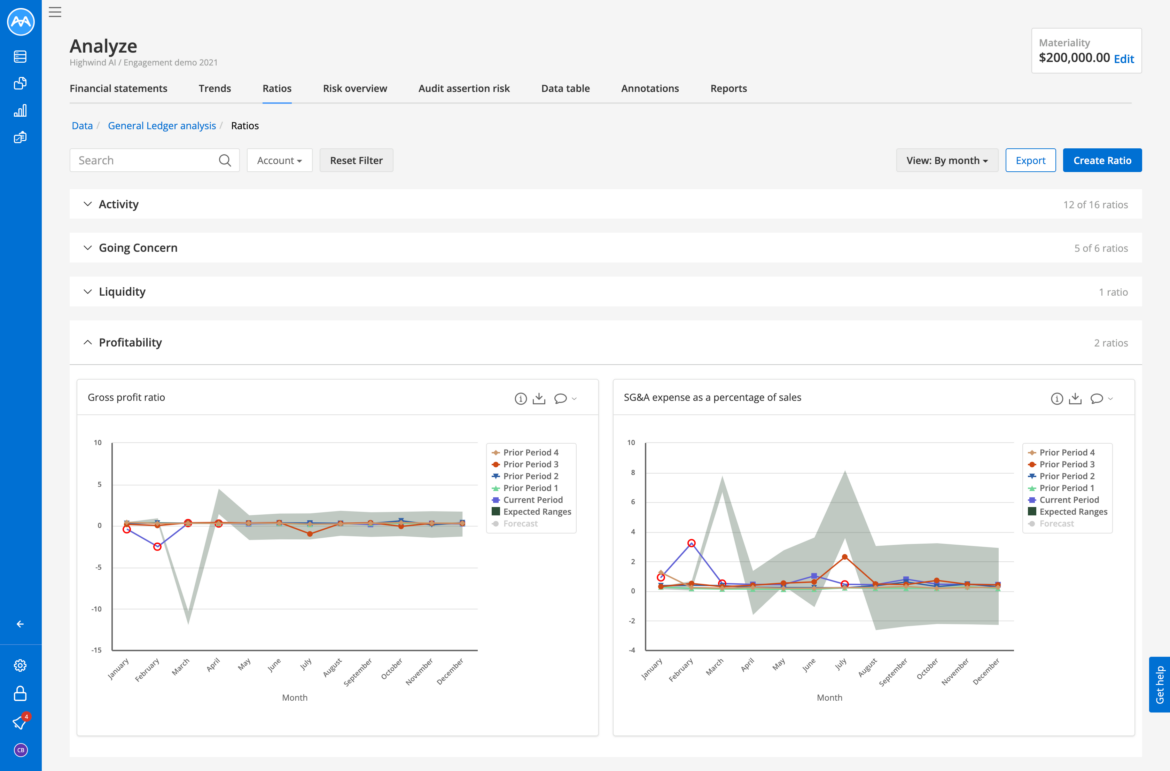

- Granular trend analysis

Compare account trends at a detailed level across periods to identify significant decreases or inconsistencies.

- Granular trend analysis

-

- Ratio analysis

Analyze key ratios between accounts and flag deviations from historical norms, which may indicate misclassifications or inappropriate capitalizations.

- Ratio analysis

By combining these features into an ‘ensemble’ evaluation, MindBridge ensures even the most subtle anomalies can be detected, giving financial reviewers the most advanced anomaly detection available today.

Best practices for fraud prevention

When it comes to fraud, prevention is always better than detection. Building a solid foundation of internal controls is the best way to minimize risks. Here are a few simple but powerful steps organization can take:

-

- Foster transparency and accountability

Create a culture where openness is encouraged, and everyone knows the value of walking the straight and narrow.

- Foster transparency and accountability

-

- Strengthen internal controls and oversight

Build robust processes to detect and prevent irregularities from the start.

- Strengthen internal controls and oversight

-

- Regular training and awareness

Continuously educate employees about the risks of financial fraud and best practices for reporting suspicious activity.

- Regular training and awareness

-

- Leverage AI-powered technology

Use advanced anomaly detection tools like MindBridge to analyze all financial data continuously and proactively identify potential issues.

- Leverage AI-powered technology

Final thoughts

Preventing financial fraud requires a combination of proactive detection methods, strong internal controls, and a culture of accountability. Advanced AI tools like MindBridge are transforming how financial records are reviewed, enabling organizations to detect irregularities before they escalate into front page news. While the human element of professional skepticism will always be essential, AI-powered tools provide the efficiency and accuracy needed to keep up with the growing complexity of reviewing financial data.

Ready to transform your fraud detection process? Discover how MindBridge can help your organization detect anomalies and safeguard its financial integrity.