In the last decade, technology has altered the ways in which we work and live. This has become increasingly true in the auditing profession.

According to Audit 2025: The future is now, a report released by KPMG and Forbes Insights that surveyed 200 CFOs, chief audit officers, chief tax officers and other financial executives, “the financial audit is poised for profound and rapid change.” That is, technology, combined with the expertise of today’s skilled auditor, allows audit professionals the opportunity to take a deeper look into an organization’s financial facets and provide more informed insights.

The Public Company Accounting Oversight Board (PCAOB), which regulates audits of publicly listed companies in the United States, recently released their own report, the Data and Technology Research Spotlight, which provides timely and relevant observations for auditors and stakeholders on the current and future of audits and technology-based tools being implemented in the industry.

It’s a mouthful, but essentially those responsible for regulating public audits in the United States are beginning to respond and acknowledge the transition we’ve been tracking (and encouraging) for a few years now: audit approaches using technology-based tools.

In the KPMG-Forbes report, 80% of respondents said that auditors should use bigger samples and more sophisticated technologies for data gathering and analysis. As technology blazes a trail through the audit space, more firms, organizations, and boards are taking notice.

Back to PCAOB report, it included an interesting statement on standards:

“PCAOB auditing standards do not preclude audit firms’ use of technology-based tools during an audit but our current standards do not explicitly encourage the use of such tools.”

While far from an endorsement, the PCAOB is the most recent major organization in the audit space to recognize the value of technology to increase the quality and efficiency of risk assessment and discovery.

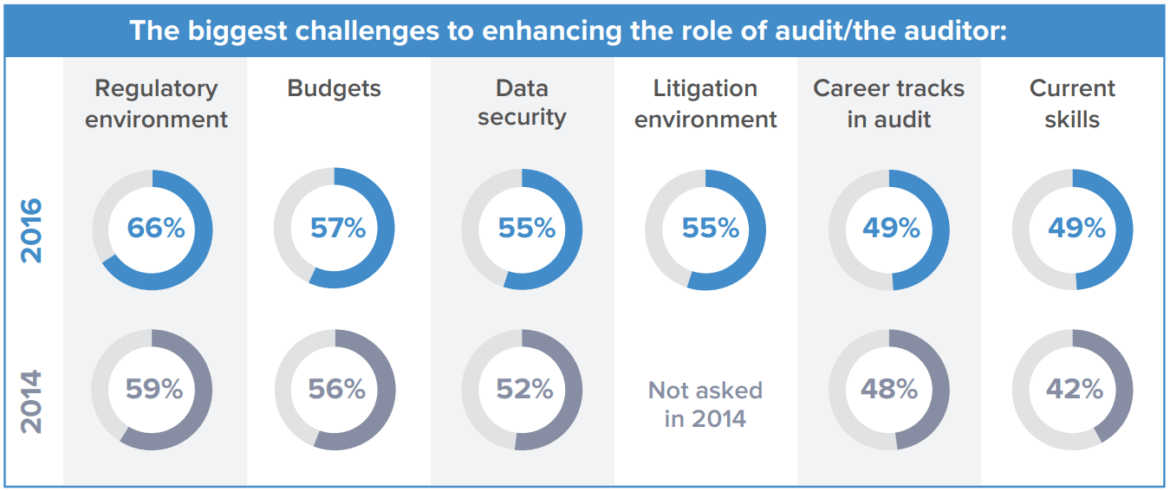

In the same KPMG-Forbes report, however, 66% of respondents noted that the regulatory environment as their biggest challenge to enhancing the role of the auditor:

Source: KPMG & Forbes, Audit 2025: The future is now

In light of this report, and the reality of auditors and accountants, we asked ourselves, what does this mean for not only public companies, but organizations everywhere that are still on the fence about integrating potentially groundbreaking technologies into their audit work?

What does this mean for the audit industry?

The use of technology in audits is not new. Currently, many of the firms governed by the AICPA’s regulations and standards use technology in their audit approach to help augment their audits and enhance their judgement.

In the PCAOB report, the board considered that “guidance or changes to the standard may be needed, given the increasing prevalence of technology-based tools and the increasing availability and use of information from sources external to the company, both in financial reporting and as audit evidence.”

Beyond the admittance of such “technology-based tools” into public audit, this also speaks to the need to update standards and regulations that may inhibit their use. This is a major step for any regulator as, historically, audit standards have struggled to reconcile the advent of tools that may increase audit quality and efficiency with storied rules that attempt to define a “quality audit.”

The AICPA and ICAEW (covering North America and England & Wales, respectively) are two major regulatory and oversight bodies that are both grappling with their relationship to new and upcoming technological advancements in accounting. AICPA, through CPA.com, are planning for the introduction of DAS (the Dynamic Audit Solution), a solution that looks to combine technology and traditional audit to bridge the gap between innovation and regulation.

The PCAOB’s stance on technologically-augmented audits has given fintech innovators—and the firms that employ their technology—room to breathe, and to consider their relationship with the long-established audit industry.

So, where do we go from here?

The PCAOB’s Digital Technology Spotlight did more than open the door for technology in public audit, though: it outright listed the benefits of digitally-augmented risk assessment for auditors, firms, and businesses everywhere.

Reports conducted like the PCAOB and Audit 2025 show that technology-based audits reap huge benefits for firms and businesses. One potential benefit noted in the PCAOB report posits that these tools provide auditors with more persuasive evidence and confident findings in their risk assessments. This corresponds with a finding in the KPMG-Forbes report which showed that 62% of respondents want their auditor to articulate a clearer point of view on critical issues.

“62% of respondents want their auditor to articulate a clearer point of view on critical issues.”

Other benefits mentioned include automating certain aspects of repetitive or less complex audit procedures like reconciling account balances to the general ledger, vouching sales transactions to subsequent cash receipts, or preparing confirmations to be sent to third parties.

With the positives mounting, it’s understandable why organizations like the PCAOB felt it necessary to take a stand on this issue, and to formalize it into their standards (albeit off-handedly). However, it was also interesting to see the benefits specifically tied to public audit.

For example, in certain instances, the PCAOB Spotlight found that technology-based tools can aid auditors in analyzing data for indicators of management bias and the ability to provide auditors with information that could even suggest revisions to their planned audit response.

Many more benefits weren’t mentioned in the PCAOB Spotlight, however. Like what automating recurring tasks can allow auditors to do, such as expanding their skill set, and allowing them more time to communicate with clients and stakeholders. Nor did it mention the marketing potential for firms utilizing AI and other hot-button technologies, from a branding perspective.

Ultimately, this report is yet another example of the wider audit and accounting community recognizing the value of technology and embracing it. Given that, you may be wondering how you, your firm, or your business can begin to leverage technology for the betterment of your audits.

Thankfully, we have you covered.

How to integrate technology into your audits

With the addition of technology to your audit methodology also comes many changes to the way data is collected, analyzed and controlled in your firm, department, or business. This can seem daunting; the idea of implementing new policies and procedures and updating a methodology that has been so good to you for so long isn’t easy.

But this change is good.

As mentioned, utilizing technology in your audit assessment has taken a long road to regulatory acceptance; technology moved too quickly to be tested and proven against the manual means of gathering and analyzing data — the person behind the calculator punching numbers worked, it seemed. However, now that both private and public regulatory boards are starting to recognize the power that using technology-based tools have in conducting audits, there is no reason not to accept the future of audit: technology.

The MindBridge Audit Approach works to empower auditors and finance teams with AI-enabled technology to automate tedious processes and provide deeper insight into financial data.

From the planning, gathering, and analyzing stages, MindBridge’s technology allows users to analyze 100% of transactions to spot anomalies and potential risks faster. We appreciate the importance of understanding 100% of the process as well.

It’s like cooking: you need a great recipe to make a great meal. If you go in blind, you may not like what comes out of the oven.

Audits should be treated with the same transparency, thoroughness, and detail. Which is why the MindBridge Audit Approach requires an understanding of your business and objectives, conducting preliminary risk assessments, evaluating internal controls, and building a plan for successful audit engagements.

Our Audit Approach Briefing Paper offers you a practical introduction to revamping your audit approach using MindBridge.