Three ways Ai Auditor strengthens your audit planning

The determination of where audit risks of material misstatement lie is a critical output of the audit planning process. Usually, identifying those risks is based on the auditors understanding of their client and the client’s operating environment. Auditors can now rely on a data-driven approach to better understand that environment. And this will positively impact the nature, timing, and extent of the audit procedures which respond to the identified risks.

Below, we’re exploring three ways that our Ai Auditor solution helps you streamline your audit planning, from start to finish.

How to enhance your audit planning using Ai Auditor:

1. Conduct thorough assessments for better audit planning

Just looking at a balance sheet or income statement at one point in time isn’t enough. Analyzing more financial data during the planning phase allows for a deeper understanding of the client’s operations.

Auditors have long used analytics to help assess a client’s operations. These tools help them gain insights and identify aspects of the entity that were either unknown or unfamiliar to the auditors. These data analytics essentially help them to better assess the risk of material misstatement, as well as provide a basis for designing and implementing responses to the assessed risk.

Working with Ai Auditor, the auditor can select a view of the ending balance or monthly activity. They can also analyze different transactional relationships within the general ledger to ask better questions and make more precise judgement calls.

For example, let’s say an auditor finds out the accounts receivable (AR) has a 10% change from the prior year to this year. The auditor can explore the AR activity and find out if this change was a normal increase or if there was any unusual activity that could indicate a new large customer or purchase at year end.

Another example would be if there was an account that had no significant change from the prior year ending numbers, but the activity was much different. Having more data would provide the auditor with better insight into the client’s operations.

Using Ai Auditor, an audit team can also look at relationships between accounts to identify if there are any unusual patterns. For example, perhaps they’ll notice that the cost of goods sold (COGS) and inventory trends appear to not follow consistent patterns. The auditor can then include a very specific and strategic task in the audit plan — to pinpoint the time when the trend does not follow expectations and investigate further.

2. Quickly identify unusual transactions across all data

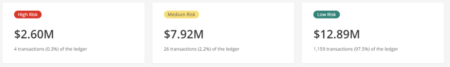

The MindBridge Ai auditor solution automatically scores the risk of each transaction using Control Points. These Control Points include tests based on business rules, statistical models, and machine learning to identify the most uncommon and unusual items in the data set.

The machine learning engine in Ai Auditor looks at each unique data set and analyzes the frequency and amounts of the transaction. The engine also explores relationships between the account’s transactions that are being recorded.

Ai Auditor helps automate the analysis by flagging items that just don’t fit typical transaction patterns. It’s then up to the accountant to focus on the most uncommon and unusual items and dig deeper.

For example, Ai Auditor might flag the write-off of inventory because insurance-related payments seem uncommon or unusual. During the audit, the auditor might learn that this was due to a warehouse fire.

Essentially, the platform gives auditors better visibility on these unique circumstances right from the start of the audit. The auditor can then focus on these higher risk transactions, consider the ramifications of the transactions, and understand how those riskier items might impact the financial statements.

3. Retrieve and view transactional breakdown by audit area

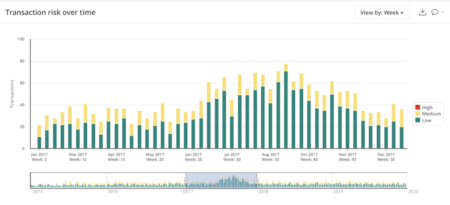

Using Ai Auditor, an accountant can filter risks by category. This allows them to breakdown risk by account, branch, program, type of transaction, time, monetary value and more.

With this breakdown, the auditor will gain a better understanding of where relative risk lies across operations. They will also be able to see which control points are being triggered within a specific area and consider how that impacts the overall audit risk.

For example, let’s assume an auditor notices that the accounts payable (AP) entries are triggering a significant amount of risky transactions at year end, specifically in the Southwest branch of the operations. This might indicate cutoff issues. Or, if the sequence gap control point is triggered, perhaps the auditor will assume there are completeness issues.

During audit planning, auditors who think critically about how these control points might factor into the assertions for the various accounts will drive stronger results.

A stronger audit plan leads to stronger audits

A deeper level of critical thinking in the audit planning stage ensures a more efficient and effective audit. Auditors can leverage our MindBridge Ai Auditor solution as a feedback loop to further their understanding of the client’s operations.

Using the AI auditing platform, accountants can then uncover valuable insights to supplement their discussions with management and existing knowledge of the client. Those insights might include uncommon patterns in transactions, abnormal stratifications, unusual relationships between accounts, and breakdowns of trends or ratios. With this information at hand, auditors can ensure a well-planned and successful audit.

Do you think audit analytics make auditors even more relevant? We do. Read this next blog to find out more.