As someone who has worked in big-firm transformational change for quite a while, I’ve often reflected on the perils of success and its ability to stand in the way of innovation and agility. We work really hard in transformation teams to articulate URGENCY, and NECESSITY, and ABSOLUTE DIRE NEED to transform. But no matter how creative we are, without a great deal of immediate pain, it is incredibly difficult to steer a new course for big ships that have been historically successful.

Undeniably, COVID-19 is a catalyst for urgent and mission-critical pivoting across most areas of professional services, and indeed business in general.

I’ve been checking in with many of my clients and industry colleagues over the last couple of weeks, seeing how I can help them, seeing if they’re ok. This has helped me learn a lot about how many audit firms across Australia and New Zealand are coping.

CLOSING | DECLINING | PROVIDING | THRIVING | |

|---|---|---|---|---|

CURRENT STATE | Hibernating or liquidating | Open (just), panic over decline in recurring revenue | Open and BAU (as far as the market is aware) | Open & thriving |

REVENUE MIX | None | Traditional recurring engagements only | Mostly traditional recurring engagements | Maintained traditional recurring engagements, adding parallel services and /or opportunistic blue-sky work |

CLIENT APPROACH | In the wind | Overwhelmed by client emotional burden | Reactive client emotional support | Proactive, deliberate and direct client management |

WORKFLOW FOCUS | Nil | All client work reducing | Laser focus on core client deliverables | BAU on core + new (relevant) service offerings |

STRATEGIC FOCUS | Nil | Holding breath, can’t see past next week | Wishing for the dust to settle | Planning for acceleration when the dust settles |

Regardless of which state you and your firm fall into, no one will argue that ‘business as usual’ is no longer a thing. All those posters we’ve all seen about needing to embrace change seem to have come rushing at us all with force.

The push-pull between audit quality and efficiency

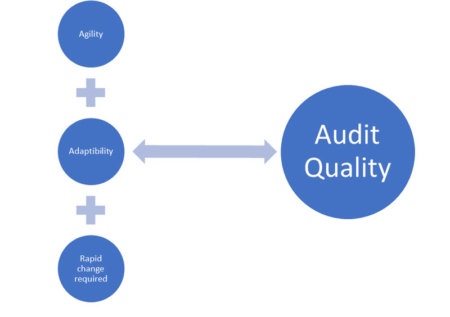

How are firms around the country reconciling the absolute mission-critical need to be agile, to adapt, to change rapidly while protecting their sole reason for existing: Audit quality?

Materiality

Many firms are considering their materiality levels. Are those that have always been used still appropriate in the current climate? If lowering them is most appropriate to capture risk properly, how will firms deal with the significant uptick in sampling effort required as a result?

Focus on fraud

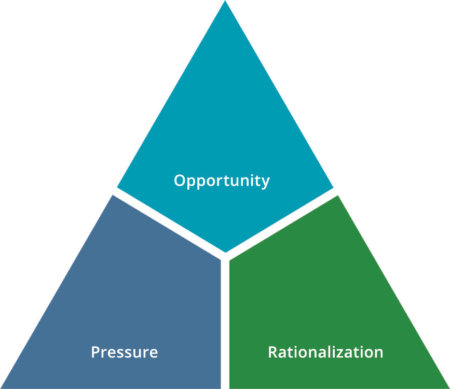

Pressure – Employees within our client’s businesses will be under enormous stress, thinking about potential job loss, financial strain, and social distancing.

Opportunity – Management review may not be as vigilant due to distractions by the crisis and other management responsibilities, and internal controls may be circumvented in times of crisis for the reason of expediency to keep business processes operating.

So firms are considering how they can appropriately resource, looking more closely in areas that are ripe for fraud in these economic conditions – areas like payroll, termination payments, shrinkage of inventory, revenue recognition…anywhere where there’s not great segregation of duties, management override of controls, etc.

Big picture mindset

Following a normal process, one designed for ‘business as usual times,’ is just not sufficient in the current state of COVID-19, so firms need their auditors to step back and look at more of the big picture. Considering the broader context of what they’re doing, evaluating the effects of COVID-19 and surrounding behaviours on their risk assessments is critical for effective audits. This requires perhaps more space and ‘thinking time’ than the normal production line of audit engagements so again, firms are contemplating the effect of this change on resources and profitability of current engagements.

Carrying on as normal is unacceptable. What was identified as the top risk when you did your audit planning and risk assessment —what you are auditing as you read this —is almost certainly not the top risk today.

Normal Marks, author of Auditing That Matters

Each of these considerations means a diversion from very structured and process-driven methodologies and practices that have been refined over the recent years to deal, in many cases, with the downwards fee pressure on audit engagements. And pivoting away from ingrained processes risks the need for more WIP and more resources.

As Tim Kendall, BDO National Leader for A&A shared with the AFR recently: These things coupled with any rigidity in ASIC’s views around current financial reporting time deadlines pose a significant risk to audit quality as firms are forced to squeeze engagements into a very tight delivery timeframe. (full AFR article HERE)

The key difference between those firms who are Closing, Declining, or Providing and those firms who are Thriving is simple – either an ongoing commitment to best-of-breed tech to support the most efficient and effective high quality audit engagement delivery OR an immediate prioritising of adoption of such. Or both.

Thriving firms already have, or are seeking to have, tech that provides ways to be more efficient AT THE SAME TIME as expanding the lens to have a broader contextual view of risk.

Read more

How auditors use AI-driven ratios to understand risk