The public’s trust of governmental budgeting, fiscal management, and reporting is at an all-time low, especially in the aftermath of the 2008 financial crisis, where only four out of ten people in OECD countries expressed confidence in their government. Cases of fraud, bid-rigging, and pay-to-play are never far from the headlines, and have continued to undermine trust in the public servants and elected officials tasked to oversee the complex work of managing government finances.

A large portion of this mistrust can be attributed to the struggle that government finance managers and auditors are facing in analyzing the increasing amount of financial data. Current financial control and audit techniques, including legislated audit requirements, are not able to scale to keep pace with the massive data explosion coming from their own accounting, payroll, and expense management systems. One government response to this issue, open data, enables a sense of fiscal transparency with the public but it doesn’t replace the rigorous professional analysis required to identify fraud, errors, and omissions in large amounts of data.

Enter artificial intelligence (AI). Leveraging a mix of machine learning and natural language processing (NLP) techniques, AI can help government auditors and finance officials deal with the massive amounts of data they are required to professionally process in a timely fashion to meet their fiduciary responsibilities to their taxpayers, which in turn will help restore the public’s trust in government.

The financial data explosion in government

Imagine you are running a government department that has 150 different operational entities but only have the resources to audit four or five a year. That’s a massive financial blind spot that will make your comptroller or CFO lose sleep at night. It’s not a question of whether fraud or errors are occurring, it’s a question of when the news will break that they have happened.

Equally challenging is the government audit department that must perform 150 audits per year by legislative mandate. With so many audits required, where is the time to dive into different areas of analysis and reveal insights that can help lead to improved service to the public?

PwC estimated that 18 zettabytes of financial information was created globally last year. Visualize a standard pitcher of water as a byte. One zettabyte is all the water on planet earth. PwC also estimates that only 0.5% of that data is analyzed, and it’s in this unreviewed data that the errors, omissions, and frauds that the press reports on is occurring.

Let’s also be clear on what governments are catching in the data they are analyzing. Current financial controls, audit methodologies, and analytics catch about 3% of the total global fraud as estimated by the Association of Certified Fraud Examiners. Tips, on the other hand, uncover 50% of the major corruption cases.

Current government processes and professionals are not catching the errors faster than whistle-blowers are reporting it. So it’s not surprising that governments are perceived as being ineffective in how they deal with the detection of fraud and errors in their financial statements.

Fraud hotlines & open data: First steps

Governments have responded to this issue in a number of ways. One of the first has been the rapid rollout of fraud hotlines, driven by statistics on how fraud has been uncovered to date in the majority of cases.

The other approach has been to broadly publish budget, financial, and audit reports to the public. This approach has been tied to the open data/open government movement and has been seen by many as a more citizen-inclusive approach to solving this problem. The idea is, by releasing all the data to the public, concerned citizens can dig into finances and find errors and mistakes to help share the burden of analysis.

This refreshing approach to transparency in government has its benefits, including seeing governments become better stewards of their own data, and being more open to feedback. However, the open data movement hasn’t been able to put an end to the public’s mistrust as first promised. Missteps in areas such as the standardization of data formats and APIs, the frequency of updates to the released data sets and the scope of the data released has limited analysis by external parties.

In addition, as larger data sets are released, individuals are no longer able to perform a full analysis of the data in a single pass. Microsoft Excel, the world’s most widely available financial analysis tool, has a million-row limit for data processing, and other available data science and accounting tools and resources are out of reach for the majority of citizens. The data might be readily available, but the professional tools and skills are not.

Artificial intelligence: Creating government efficiencies

Artificial intelligence is part of what is being dubbed the Fourth Industrial Revolution and has the ability to dramatically improve the efficiency of organizations. In the financial and audit worlds, AI offers an approach that includes:

- Continuously ingesting large amounts of financial data from different sources

- Risk assessing 100% of all transactions against all current and past data

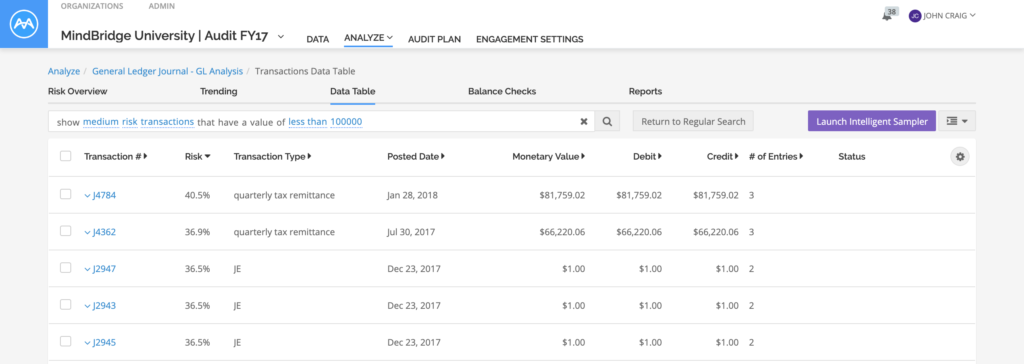

- Indexing all transactions in a way that can be interrogated with common language questions, such as “Show me all transactions with high risk at the end of 2018”

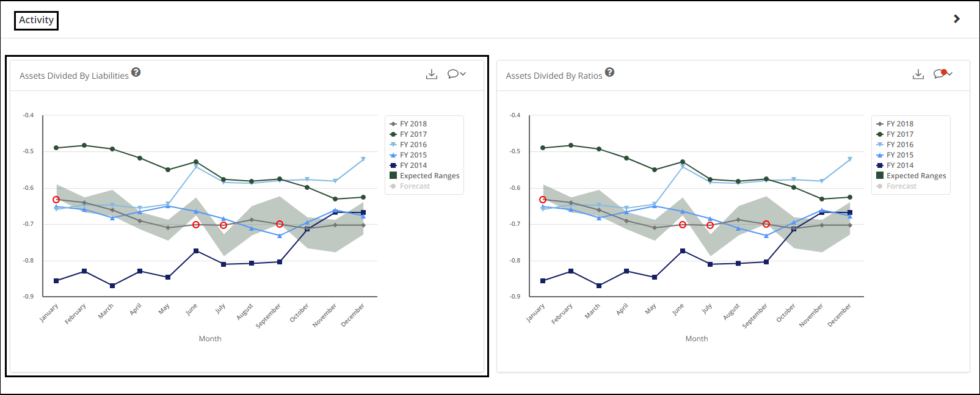

- Producing reports that allow auditors and financial officers to extract insights into how their government is operating, and take corrective or reinforcing actions accordingly

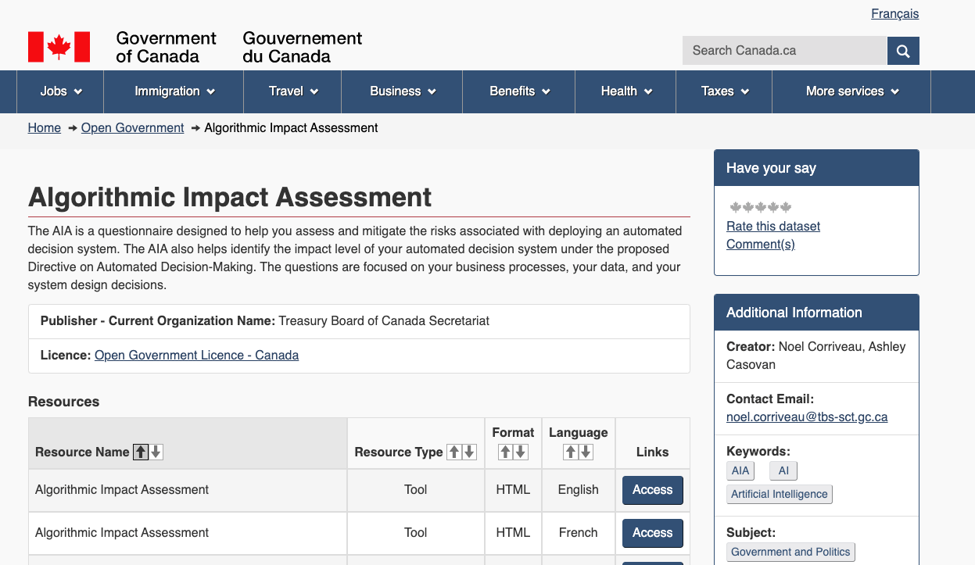

In this way, AI builds on what the open data movement has started, as it offers a means of democratizing the application of complex analytics to governmental financial review. Governments can now load and analyze all their financial data, applying the open government standard of transparency to both the data and the algorithms they are using, and then releasing the results for the public to review when completed.

AI solves the problem of the department with 150 potential audits and having the resources to run 4-5 audits only. AI can run continuously on every department and help to direct the limited resources to the departments that exhibit high risk instead of burning resources using round-robin audit approaches and random sampling of transactions to review. For the departments not chosen for an audit, financial managers can be sent risk reports in each department allowing them to take corrective measures in advance of a future audit.

And for the organization facing 150 mandatory audits, AI can drive cost efficiencies as standard procedures can be automatically performed, freeing up auditor time for deeper interrogations of the data.

AI can also make fraud hotline tip review more efficient, namely the requirement that anonymous tipsters have to be convinced to give up their anonymity to prove the claim being made is true. Upon receiving a tip, an AI tool can be directed to review the data claimed at risk. This allows the financial data to speak for itself, relieving the tipster of having to reveal their identity early on in the risk assessment of the tip.

Artificial intelligence: Finding financial anomalies

So how does AI find anomalies in financial data and allow auditors and financial officers to search the data quickly? These capabilities are found in the application of machine learning and NLP.

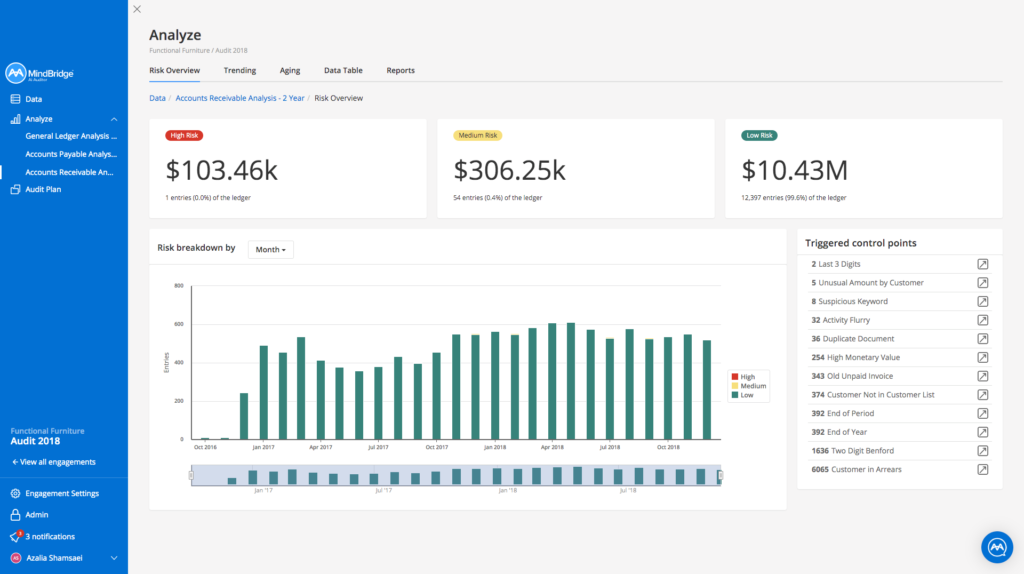

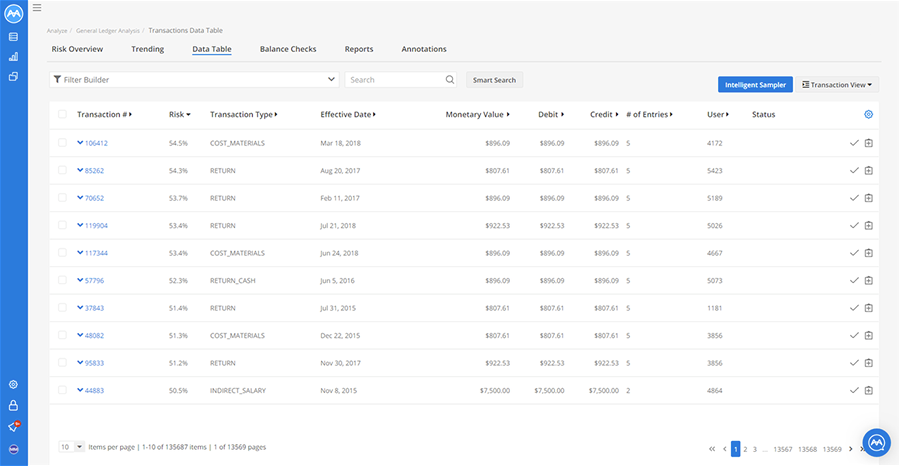

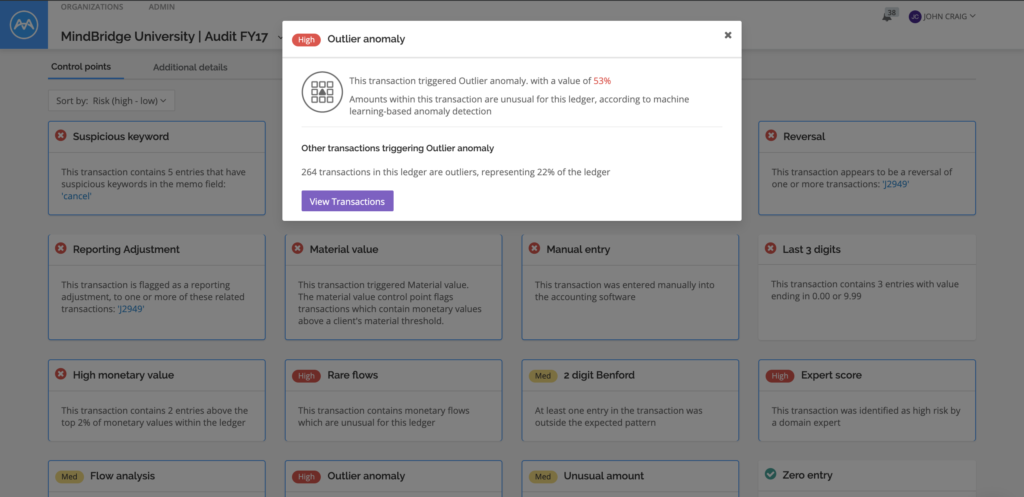

Machine learning is a sub-field of artificial intelligence that focuses on the application of algorithms to large amounts of data to enable further insights. MindBridge Ai uses both supervised and unsupervised algorithms to risk rank all the financial transactions loaded into platform. Supervised algorithms are based on training data, and we developed an algorithm based on known patterns of fraud that was provided to us by forensic accountants.

Unsupervised algorithms are special, because they are developed to allow the data to speak for itself, meaning that transactions are clustered into neighborhoods of numbers that are interesting to accountants, such as rare connections between two accounts. These algorithms can also identify transactions that fall outside neighborhoods of numbers, called outliers.

These algorithms, run in concert with standard accounting rules and statistical techniques, such as Benford’s Law, allow us to risk score every transaction in a financial ledger. While this is done, the data is also indexed for rapid search capabilities, which brings us to the application of NLP.

NLP is another sub-field of AI and, in the accounting context, allows auditors and financial officers to ask questions of the data that has been risk ranked using machine learning, returning a list of risky transactions that fit the criteria.

Together, machine learning and NLP have been empirically tested to show that we can conservatively detect financial anomalies 10-30x better than current audit and financial analysis methodologies.

Artificial intelligence: Restoring public trust

The inability of government audit and financial departments to analyze 100% of the data in the government’s trust has been a major factor in its inability to spot financial anomalies. While fraud hotlines and open data techniques have been a step in the right direction, AI offers an opportunity for the government to actively pursue the detection of financial anomalies before whistle-blowers think to act on ethical and moral grounds.

Private sector audit firms are already turning to platforms such as MindBridge Ai Auditor, and over 40% of the top 100 audit firms in North America are currently engaged with us. In the public sector world, the auditors and financial officers in the Canadian and UK federal governments have already tested the MindBridge platform and measured the advantages of using AI against current techniques.

Students in accounting programs at over 60 universities in Canada, the UK, US, and Australia have also engaged in using Ai Auditor in their accounting courses. As AI-ready individuals move to becoming workers and taxpayers, they will demand that AI be employed by all levels of government to help in the detection of fraud, errors, and omissions in financial data. Citizens are already becoming aware of the capabilities of AI, as they hear about it every day in its application to autonomous vehicles and other government services, such as automated government decision making.

The Fourth Industrial Revolution is upon us, and there are significant benefits for governments in the early application of AI to detect financial anomalies to turn the tide on fraudsters and bad actors. Beating whistle-blowers to detect and mitigate fraud is an achievable goal through AI and will make major leaps towards restoring the public’s faith in a government’s ability to manage the public’s finances.

To learn more about our government solutions, including real use cases, visit our government finance page.