Upon its launch in 2022, ChatGPT single-handedly took “AI” from a futuristic concept to reality – and to the top of the agenda for many finance professionals. For the first time in a long time, there is the promise of transformational technology in the finance department.

There is only one crucial issue: ChatGPT and its competitors are built for language applications and are not very capable of handling numerical data.

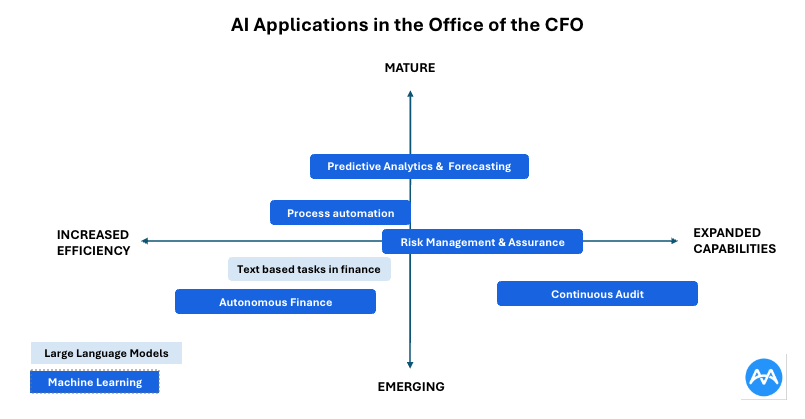

As finance teams develop their thoughts on how AI will transform their work and what steps they should take, we will give a practical overview of what technologies today provide valuable applications for finance.

Large Language Models such as ChatGPT are designed for text applications.

The core technology behind ChatGPT and competitors such as Google BERT are Large Language Models (LLMs). LLMs are designed for natural language processing tasks. They excel at tasks focused on textual data such as text generation, completion, question answering, and language translation.

LLMs work by predicting the next word in a sentence based on evidence drawn from training data. During training, the model learns to predict the next word or token in a sequence based on the context provided by preceding words. Fundamental enablers for this technology are both vast amounts of training data, which in the case of LLMs is supplied by the internet, and vast amounts of computing power, which is provided by modern GPUs.

For text-based tasks, LLMs are astonishingly capable. However, this is not the case for numerical data. For numerical data processing in finance, LLMs can be helpful in specific contexts where numerical data is embedded within or associated with textual data. They can help by tokenizing, normalizing and cleaning the text associated with the numerical values. But LLMs are ineffective for tasks primarily involving numerical data processing, such as numerical analysis, regression, time series forecasting and anomaly detection. And they are not suited for the processing of hundreds of millions or billions of rows of financial (ledger) data.

Large Language Models will play a role in the CFO office for efficiency, speed, and quality in reporting, compliance, and communications.

LLMs primarily provide finance use cases that increase the efficiency of language / text-based activities and effectively increase productivity and quality in creating, managing, and using documentation.

In the office of the CFO, concrete applications are:

- Financial Reporting and Analysis: LLMs can assist in automating the generation of financial reports commentary and formatting.

- Regulatory Compliance and Policy: LLMs can aid in interpreting, analyzing, and creating regulatory documents, such as compliance reports, regulatory filings, and legal documents.

- Sentiment Analysis and Market Intelligence: LLMs can process textual data related to market trends, economic indicators, and industry reports to support risk assessment and strategic decision-making.

- Internal Audit and Fraud Detection: LLMs can assist in analyzing textual data from audit reports, transaction records, and internal communications to identify patterns indicative of fraudulent activities, anomalies, or errors.

- Investor Relations and Stakeholder Communication: LLMs can aid in drafting communications to investors, shareholders, and other stakeholders by generating reports, press releases, and presentations.

The implementation and use of LLMs for text-based tasks in the office of the CFO pose limited hurdles, provided data security and privacy are resolved. At the same time, their application will primarily increase the efficiency, speed, and quality of existing reporting, compliance, and communication activities as opposed to providing breakthrough new capabilities to finance teams.

Various forms of machine learning technologies can be used to create AI algorithm’s purpose built for handling numerical data.

Adaptive machine learning technologies complement LLMs in that they are designed for use with numerical data and large datasets. The two most relevant and capable machine learning technologies for the finance department are Unsupervised Machine Learning and Ensemble AI.

Unsupervised Machine Learning

Unsupervised Machine Learning is a type of machine learning where the algorithm learns patterns and structures from unlabeled data without explicit supervision. The technology operates on datasets without predefined categories or outcomes (as opposed to supervised machine learning). It is like giving a child a box of mixed toys and watching it figure out how to group them by type, color or size without any guidance. The main objective of unsupervised learning is to uncover hidden patterns, structures, or relationships within the data. In finance applications unsupervised machine learning is the most powerful available technology for sifting through financial data, finding patterns and identifying anomalies without being told exactly what to look for by learning from the data itself.

Ensemble AI

Ensemble AI is a machine learning technique combining multiple individual models to create a more powerful and robust predictive model. Instead of relying on a single model’s predictions, ensemble methods leverage the diversity of multiple models to improve accuracy, generalization, and robustness. The predictions of multiple models are then aggregated to obtain a final prediction. This can be done through various strategies, including averaging the predictions, taking a majority vote, or using more complex techniques like stacking or boosting.

Unsupervised Machine Learning and Ensemble AI is particularly suited for the development of applications that discover the “unknown unknowns,” making them particularly powerful for the automated supervision, execution and error detection in all financial ledgers and financial flows. In addition to these qualities, these technologies can be scaled to analyzing the enormous amounts of data present in a corporations’ General Ledger and Sub-ledgers.

While these technologies have been developed over the last decades, they have now reached a maturity that they can be used to develop novel applications for the finance department that not only increase efficiencies but also provide new and significant added capabilities.

Sophisticated machine learning technologies such as Ensemble AI are the most powerful available AI technologies to deal with the enormous amounts of unstructured numerical data generated by enterprise operations and financial transactions.

The most prevalent applications of machine learning technologies in finance departments are in forecasting, automation, and risk management.

- Forecasting: Forecasting, as a crucial part of financial planning, budgeting, and decision-making, can be supported and, under certain circumstances, fully automated using machine learning technologies. Most importantly, by analyzing historical financial and operational data, forecasting technology can make predictions on a massive and granular scale. Improved speed, increased frequency, automation, and the removal of human bias are benefits provided by modern forecasting technology.

- Risk Management and Assurance: Ensemble AI today can be effective at monitoring all financial flows in an enterprise, such as O2C, P2P, vendor, payroll, expenses, and revenues, thus reducing the number of errors committed and increasing the likelihood of detection of errors and fraud cases when deployed as part of AI for internal controls over financial reporting (at MindBridge we call this AICFR™).

- ARs and APs execution: Robotic process automation today is effective at automating repetitive and manual tasks such as invoice reconciliations and accelerating accounts payable and receivable operations. The combination with LLMs will undoubtedly increase the capability and effectiveness of these tools

- Reconciliations: Automating the reconciliation of bank statements, credit card statements, and ledger accounts. This includes matching transactions, identifying discrepancies, and resolving unmatched items, which improves accuracy and efficiency. LLMs in combination with machine learning will increase the capability of these tools further.

- Payroll, O2C, and P2P process execution: Payroll, order-to-cash, and purchase-to-pay processes can be increasingly automated, often by deploying a combination of technologies, including machine learning and LLMs.

What’s next? Both “Autonomous Finance” and “Continuous Audit” are emerging concepts that rely on the continuous advancement of AI technologies including machine learning and LLMs.

While Autonomous Finance and Continuous Audit are both terms for concepts that to date are rather strategic outlooks than productized reality, both are undergoing rapid development. The combination of both LLMs and machine learning AI technologies will be contributing to rapidly improving capabilities.

Autonomous Finance

Autonomous finance is often used to refer to highly automated finance processes that require minimal to no human intervention. It is a broad term that encompasses all applications mentioned above and thus heavily relies on machine learning and automation technologies.

Continuous audit

Continuous audit is an automated, ongoing process that uses AI based anomaly detection technology to perform audit-related activities, such as data analysis and monitoring, on a real-time or near real-time basis. This approach enables immediate identification and resolution of issues, ensuring accuracy and compliance in financial reporting and operational processes.

Next steps: AI will permeate the Finance department via two avenues. Existing applications incorporating AI features and new AI-enabled tools that are purposefully introduced into the finance tech stack.

“AI upgrades” to the existing tech stack

It is hard to imagine a software vendor today that is not working on enhancing its software tools’ capabilities by using AI technologies. No doubt we will see continuous, incremental AI driven improvements mainly by increasing the degree of automation and efficiency of these tools. These advances are addressing primarily the concept of “Autonomous Finance”. To a lesser degree we can expect some transformational advancements based on the adoption and integration of the latest AI technologies into these tools.

New tools and capabilities

The latest advancements in AI technologies are spawning the development of new applications that will increase efficiency and provide new capabilities to professionals in the finance departments. For “Continuous Audit” to become a reality, fundamentally new approaches and products need to be developed that can handle the monitoring, anomaly detection and data handling capabilities required to perform this analysis at huge scale and in near real time.

The momentum for AI in the finance department is still building. But it will no doubt permeate and in the coming years transform finance. As we enter an era of AI induced rapid technological change, Finance teams need to stay informed on the emerging technologies and make the testing and incorporating of new tools part of their continuous audit and autonomous finance roadmap and budgets.

How do you see your finance responsibilities changing in the coming year using AI’? I would love to hear from you! I can be reached under matthias.steinberg@mindbridge.ai or on LinkedIn.

About the author: Matthias Steinberg is CFO of MindBridge.ai, a leader in AI driven financial risk discovery. Previously he was CFO of IONOS.com, Europe’s largest mass market hosting provider where he oversaw a multi-year effort to ready the company for its IPO. In the process, he developed an interest in AI technologies to transform risk management and assurance in the Enterprise.

Further reading

- Learn more about AI in finance: Navigating AI: fundamentals, concepts and applications for accounting and finance

- Get to know MindBridge: AI powered financial risk monitoring for finance professionals

- Assess your organization’s readiness for AI adoption in Finance: Take our 7-point AI-readiness assessment today