CUSTOMER ANALYSIS

Boost revenue insights to drive growth

Automate revenue analysis across customers, products, regions, and more. Enhance controls with AI tests, reducing manual efforts and gaining broader risk coverage.

MindBridge AI™ for customer revenue data

Provides actionable insights and comprehensive risk assessments across all transactional data, improving decision-making, resource allocation, and business outcomes.

Identifies hidden risks, fraud, and compliance issues using advanced algorithms, ensuring thorough and accurate transaction oversight.

Automates routine tasks and streamlines processes, reducing manual effort and time spent, allowing professionals to focus on more complex and strategic work.

Increase visibility and build risk resiliency

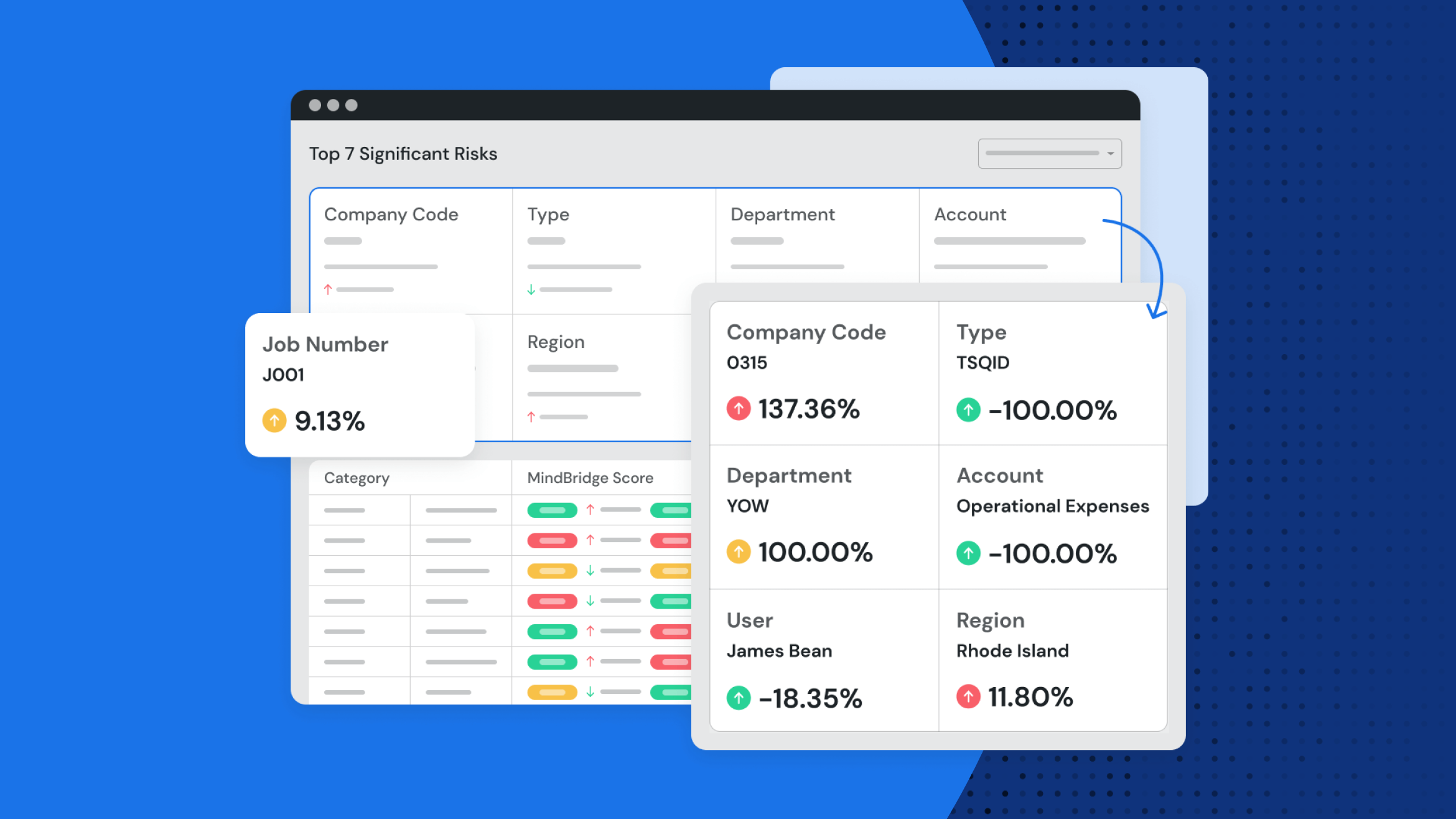

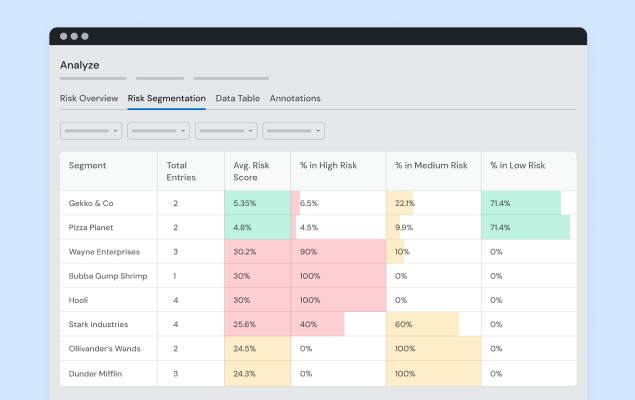

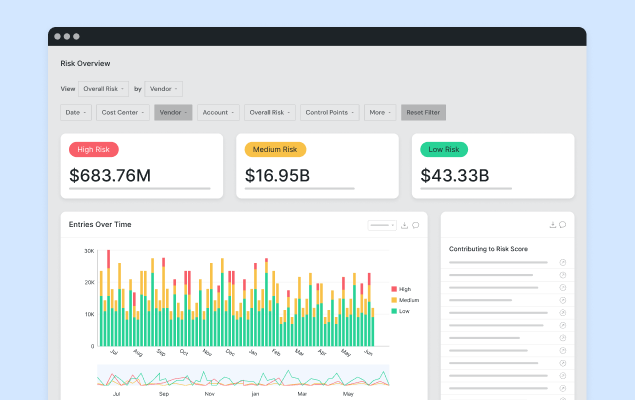

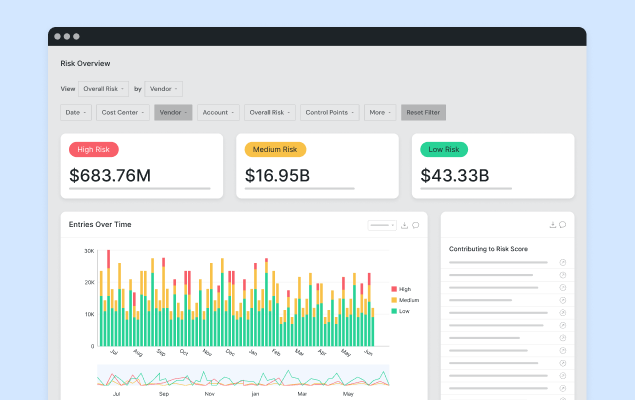

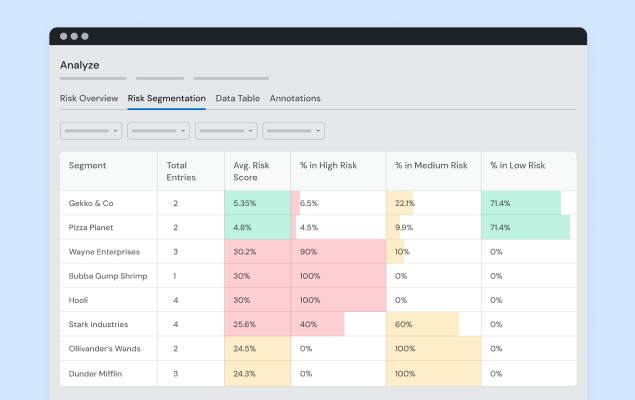

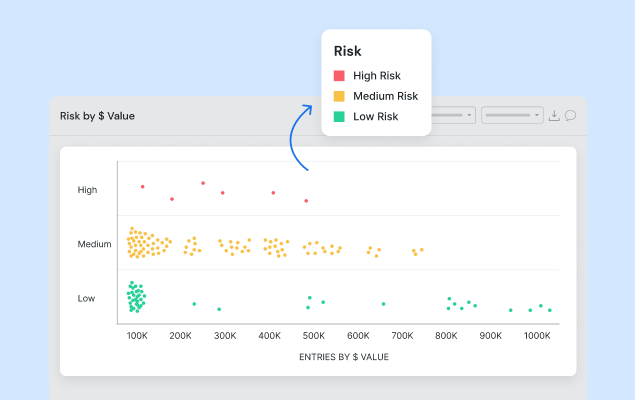

Risk segmentation

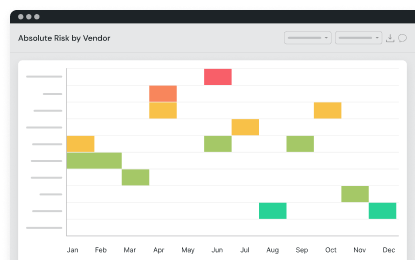

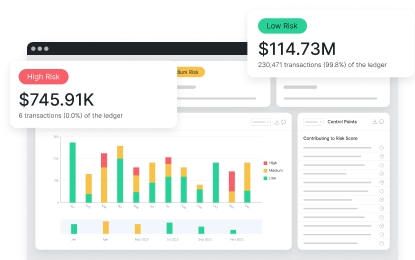

Targeted risk discovery, offering a dynamic and comprehensive view of risks within transactions across various operational aspects and risk drivers.

Documented results

Auto-generated reports based on dashboards and data exploration provide streamlined documentation for reporting.

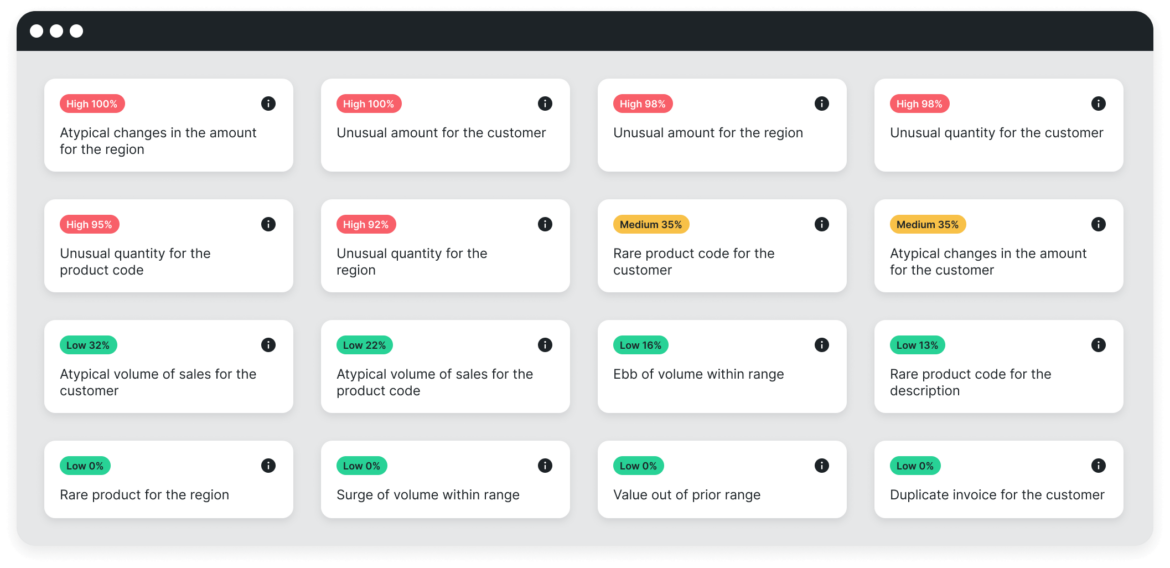

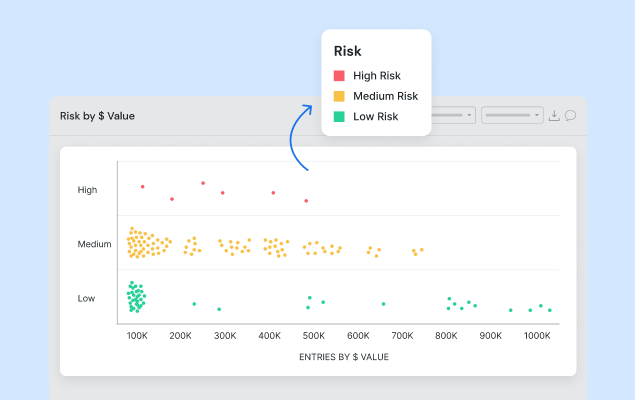

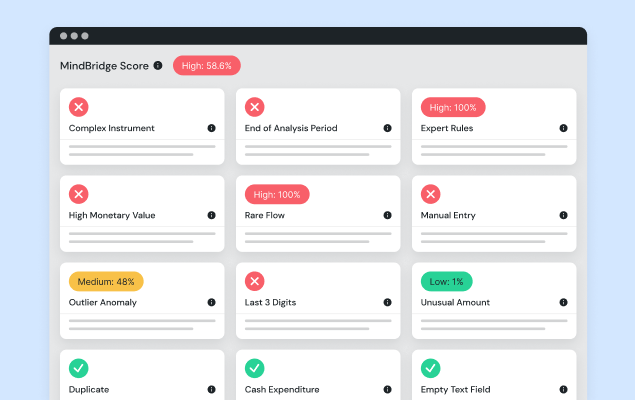

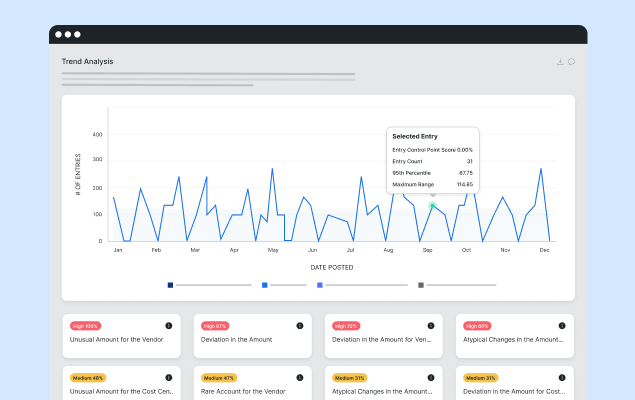

Anomaly detection

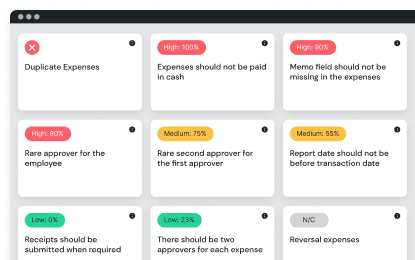

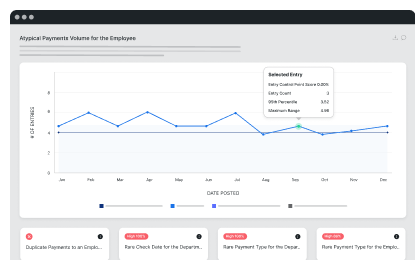

identifying irregularities and insconsistencies which may indicate potential fraud or errors, ensuring the accuracy and integrity of financial data.

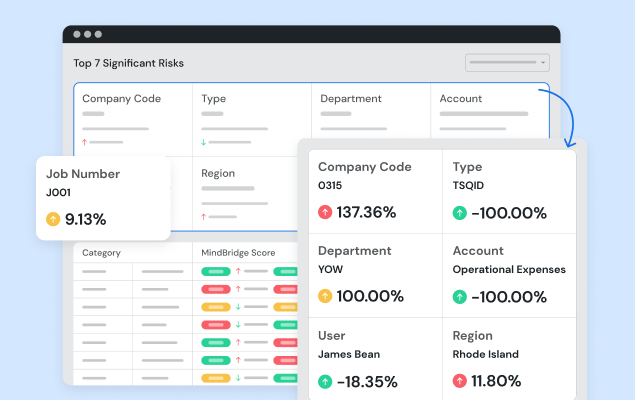

Prior period comparisons

Changes over periods are flagged based on analyzing transactional structures, risk levels, volume, and monetary value.

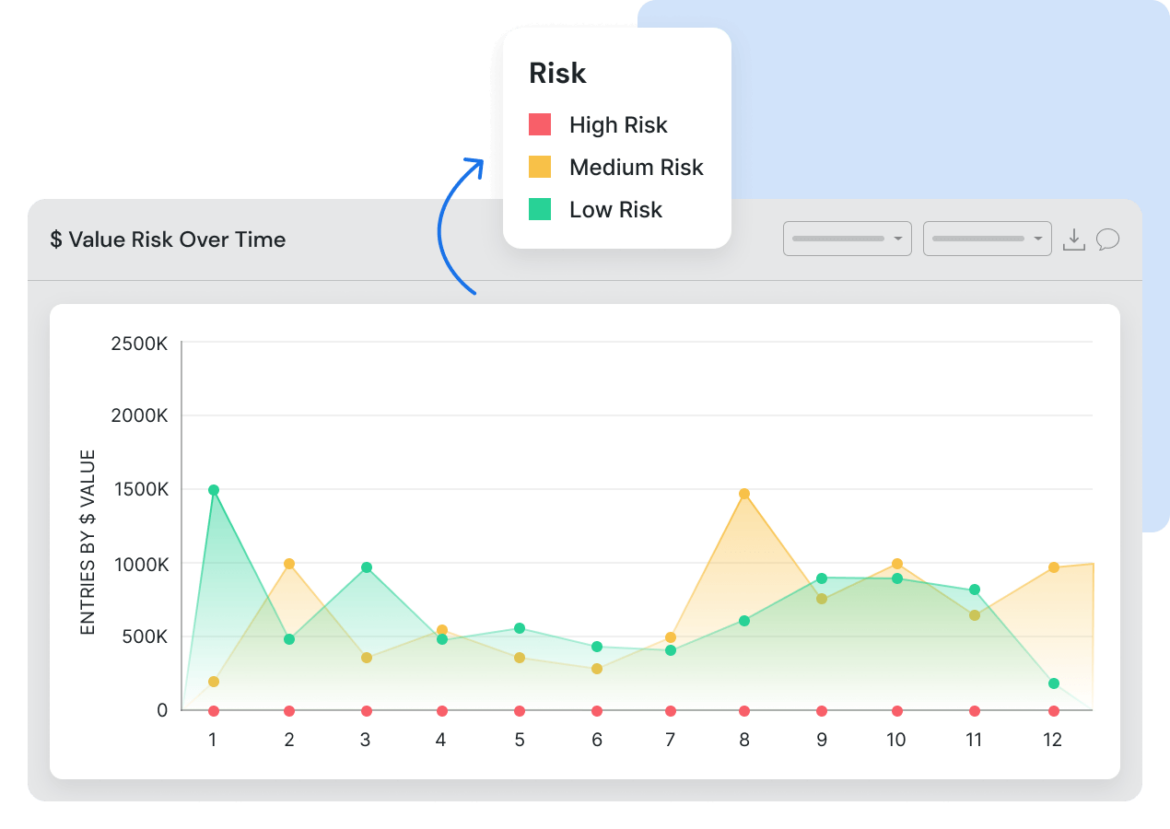

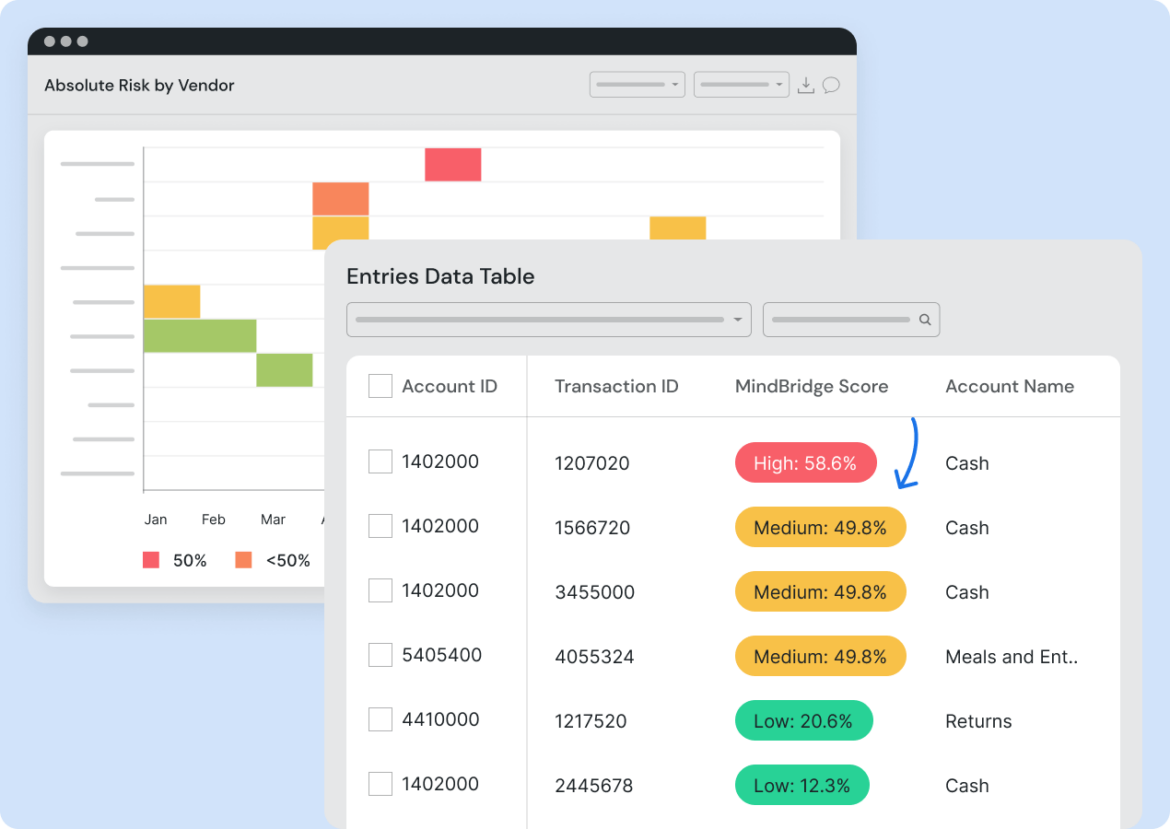

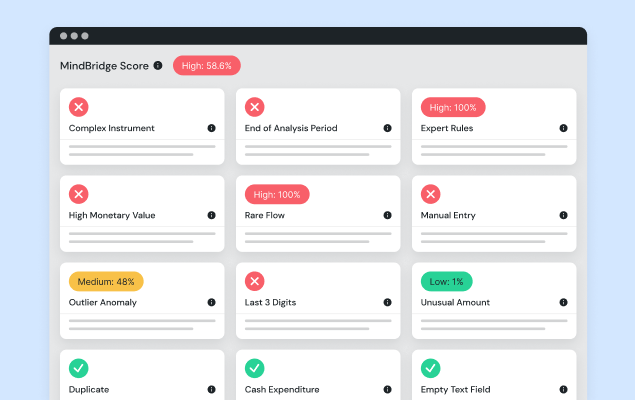

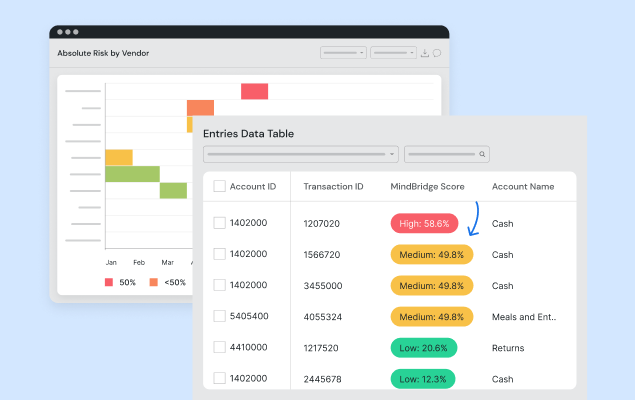

Risk scoring

100% of transactions are scored and organized based on the underlying advanced data analytics.

Why audit and finance leaders utilize MindBridge payroll risk analytics

Anomaly detection

identifying irregularities and insconsistencies which may indicate potential fraud or errors, ensuring the accuracy and integrity of financial data.

Risk scoring

100% of transactions are scored and organized based on the underlying advanced data analytics.

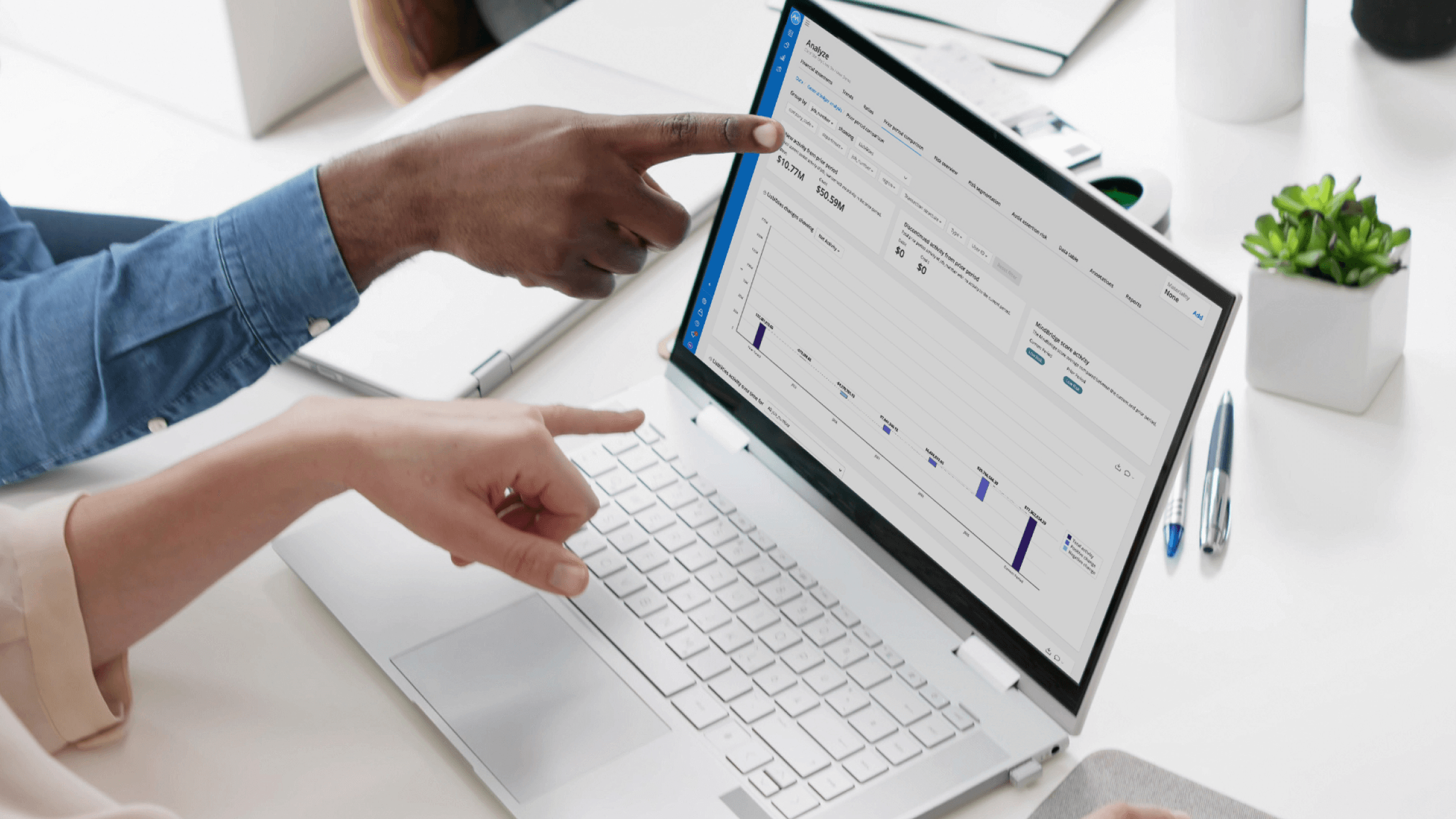

Data exploration

No scripting or formulas are required, making data exploration easy and user-friendly. Filtering capabilities allow for the handling of more complex tests, supporting nuanced financial analysis.

Risk segmentation

Targeted risk discovery, offering a dynamic and comprehensive view of risks within transactions across various operational aspects and risk drivers.

Prior period comparisons

Changes over periods are flagged based on analyzing transactional structures, risk levels, volume, and monetary value.

Configureable analysis

Configurable libraries based on industries enable the building of business rules and addition of fields to support customizable analysis.

Documented results

Auto-generated reports based on dashboards and data exploration provide streamlined documentation for reporting.

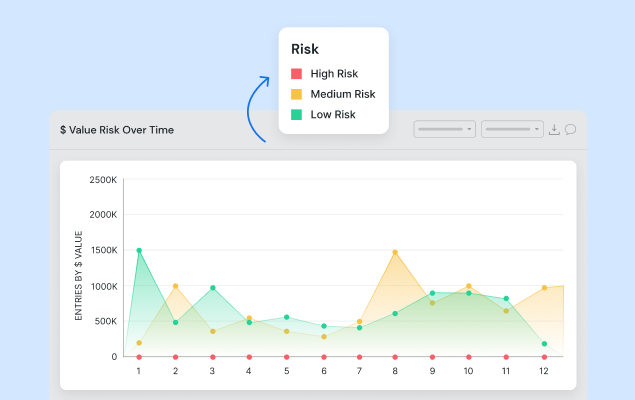

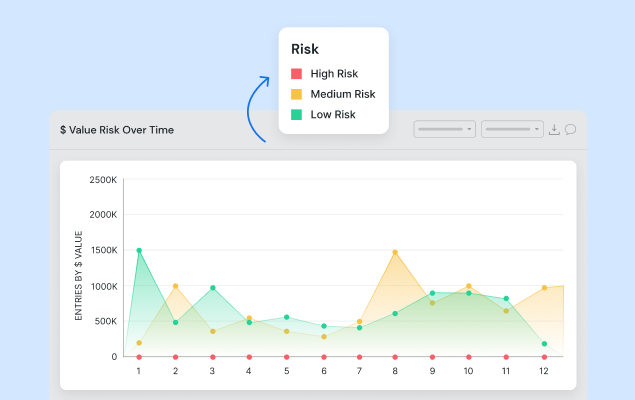

Trend analysis

Trending visualizations enable period-over-period analysis based on activity, with the capability to dynamically filter using various fields.

Browse all products

AI-Powered Revenue Risk Discovery with MindBridge Analytics

MindBridge AI™ Revenue Risk Analytics delivers a transformational solution to assess risks within financial operations.