- Products

- Industries

- Resources

- SupportGetting MindBridgeUsing MindBridgeConnecting MindBridge

- Company

MindBridge Revenue Risk Analytics

Enhance the efficiency of financial operations and reinforce trust in accuracy and reliability

Understand 100% of revenue dynamics and risks by providing insights into the factors that influence sales performance, both within and beyond an organization’s control.

Why audit and finance leaders use MindBridge Revenue Risk Analytics

Automate disaggregated revenue risk controls

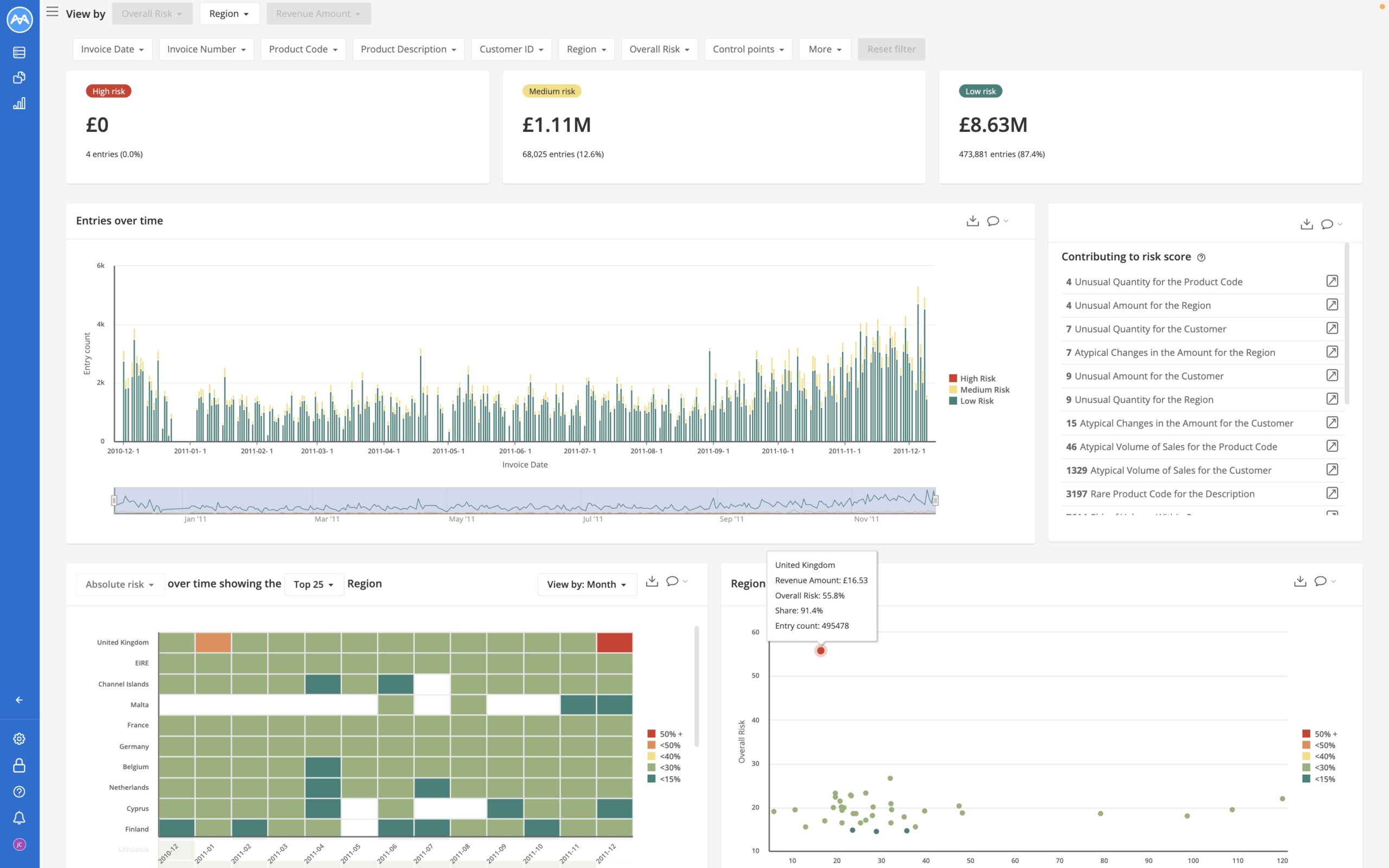

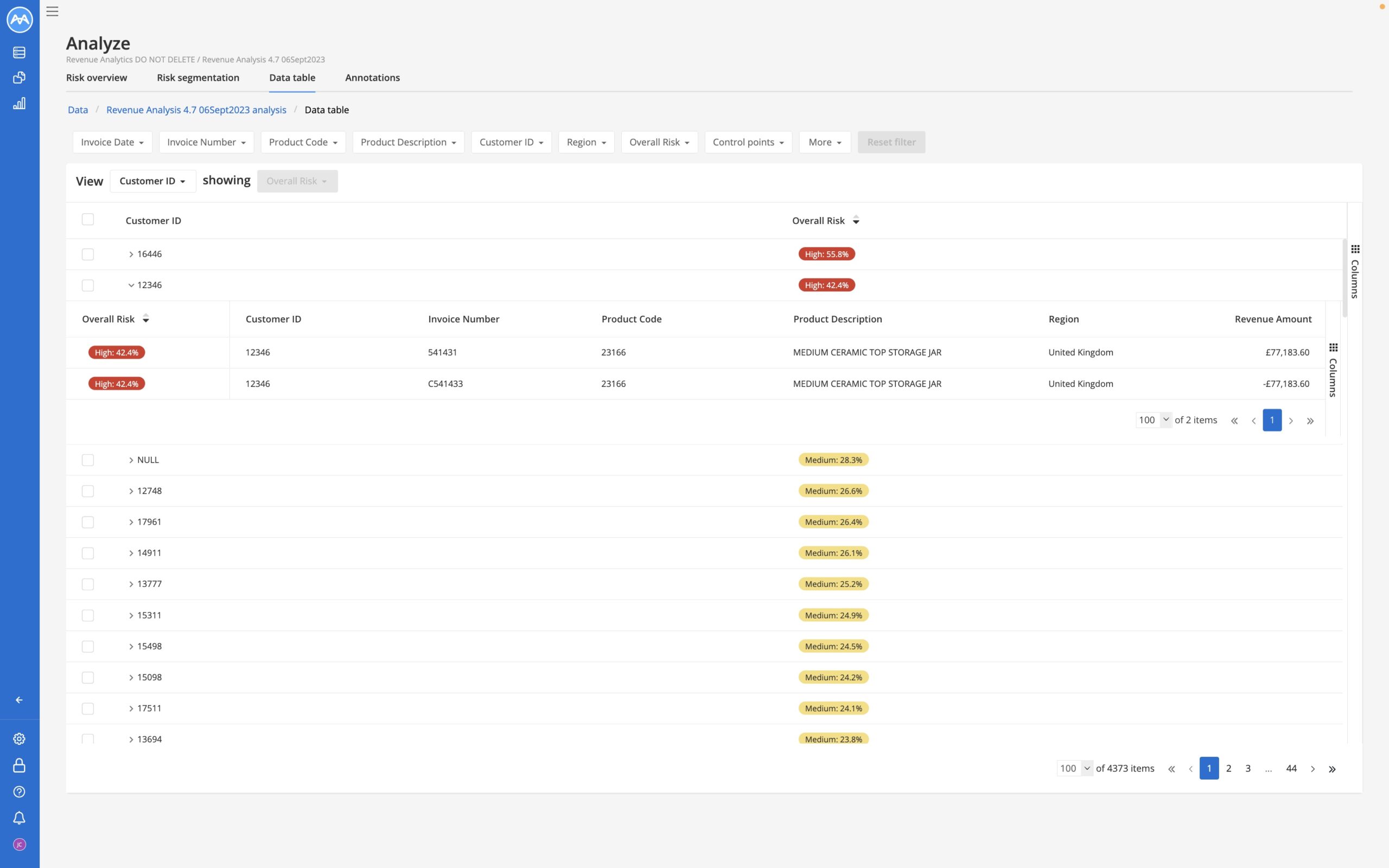

Make managing manual detective controls and random sampling in your revenue segmentation an outdated practice. MindBridge AI delivers a disaggregated revenue risk assessment across 100% of the revenue transactions flowing through a business, leading to quick and effective identification of discrepancies and anomalies.

MindBridge automates the examination of all revenue combinations of customer, product, region, and other categories important to your business and presents meaningful insights without needing to be a data scientist. Enhance your controls program with automated AI-based tests to create a repeatable process that minimizes manual tasks and allows increased focus on what matters.

Reduce impacts to your revenue stream

With a unique set of control points related to revenue analytics to help you identify opportunities and risks across key customer segments. MindBridge Revenue Risk Analytics allows you to quickly surface changes in sales activity and behavioral trends across regions, time periods, products, and customers including interesting or unusual payments, and much more.

MindBridge AI provides a unique AI-ensemble with an xAI (Explainable AI) framework that delivers explorable insights with sharable assets. Revenue Risk Analytics helps finance professionals deliver focused information to the right teams for with validated updates and process corrections against inconsistencies.

AI-Driven Revenue Risk Analytics for Transformative Business Operations

Revenue streams can be affected by various factors both within and outside your control, making them difficult to review and even more so to predict. New revenue recognition rules have added complexity to these processes, and simply comparing revenue data to previous periods is no longer sufficient.

Integrated artificial intelligence (AI) workflows, analyses, and decision-making processes, are the bridge for a transformative era where AI is your co-pilot in revenue risk analytics helping to support your global sales and revenue functions for better business operations.

Identify areas of the business that pose greater risk

Segment analysis augments the financial professional’s ability to understand and identify areas of the business that pose greater risk and complexity. Breaking down these segments supports an emphasis on high-value tasks due to an increased focus on anomalous or unusual events within the business segments.

Further, the disaggregation of revenue into categories assists financial professionals in understanding the nature of the entity’s revenue and where it was derived. MindBridge Revenue Risk Analytics delivers out-of-the-box analysis for business users focused on understanding the knowns and the unknowns related to types of goods or services, geographical region, sales channels, and more. The understanding of these categories is important to reinforce trust and transparency. Today’s finance professionals are using AI to understand the impact of how anomalies in transactional data affect revenue throughout the financial reporting process.